The Complete 2025 Founder’s Guide to Raising Pre-Seed Capital in Canada

A practical, deeply sourced playbook for Canadian founders raising pre-seed capital—what investors expect, which instruments to use, programs to tap, and how to set up your next round.

🔍 Executive Summary

Entrepreneurial ecosystems thrive on early‑stage capital. Canada’s pre‑seed market is small but dynamic, and founders today must navigate a complex mix of investors, instruments and public programs.

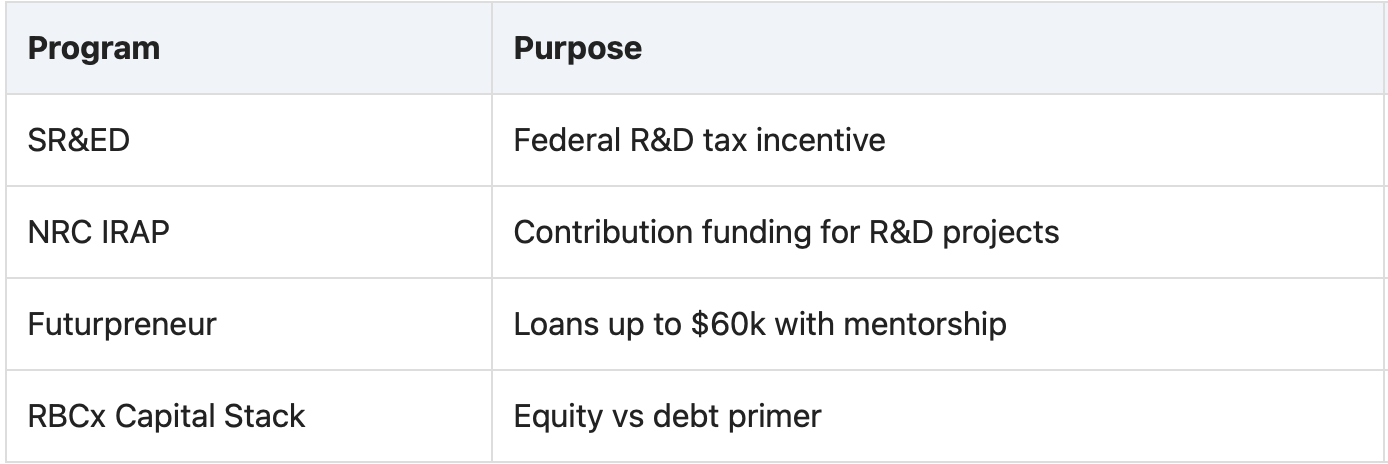

This guide demystifies pre‑seed financing — defining the stage, profiling typical cheque sizes and valuations, outlining key investor types (angels, pre‑seed VC funds and accelerators), comparing SAFE agreements and convertible notes, and spotlighting Canada‑specific programs (e.g., NRC‑IRAP grants, SR & ED tax credits, Futurpreneur).

It synthesizes recent data from CVCA and Osler reports to show that pre‑seed deals average around CAD 2.23 million and that seed capital contracted sharply in 2024–25 yet remains vital to Canada’s innovation pipeline (central.cvca.cacentral.cvca.ca).

The guide concludes with an actionable playbook for founders, investors and policymakers.

🧩 Context & Why Pre-Seed Funding Matters

Canada’s innovation economy hinges on a healthy pipeline of early‑stage startups. However, capital markets have tightened due to higher interest rates and economic uncertainty.

CVCA data show that Canadian venture capital investments reached $7.86 billion across 592 deals in 2024, but seed‑stage funding dropped nearly 50 % versus 2023 (betakit.com_.

By H1 2025, pre‑seed/seed investments totalled $297 million across 133 deals—a 16 % decline in dollars and 28 % decline in deal count compared with the same period in 2024 (betakit.com).

Fewer early‑stage deals risk constricting Canada’s startup pipeline in future years.

Yet, strong pockets of growth and support remain.

Information and communication technology (ICT) captured nearly half of pre‑seed/seed dollars, while artificial intelligence and construction tech saw notable deal flow (central.cvca.cacentral.cvca.ca).

Government programs like NRC‑IRAP (covering up to 80 % of labour costs and 50 % of subcontractor expenses (srjca.com), the SR & ED tax incentive (over **22,000 claims annually resulting in $4.7 billion in Investment Tax Credits (ITCs) claimed (canada.ca), and Futurpreneur loans (up to $20 k plus $40 k from BDC for youth entrepreneurs (hellodarwin.com) provide vital non‑dilutive capital.

Understanding how to blend private and public sources is essential for founders positioning their ventures for sustainable growth.

💡 Key Insights for Pre-Seed Financing

Pre‑seed vs seed: define your stage. Pre‑seed typically involves building an MVP and early customer validation funded via bootstrapping, family, angels, and accelerators. Seed is the first formal equity round, often raising ~CAD 2.23 M on average in Canada (central.cvca.ca).

Canadian pre‑seed capital is scarce but strategic. Canada’s average pre‑seed/seed deal size bounced back to $2.23 M in H1 2025 after dropping to $1.97 M in 2024 (central.cvca.ca, central.cvca.ca). ICT and AI verticals attract most funding (central.cvca.ca).

Use flexible instruments. SAFEs (Simple Agreements for Future Equity) are equity instruments without interest or maturity dates; convertible notes are debt with interest and a maturity date (rbcx.com). Discounts (5–20 %) or valuation caps incentivize early investors (rbcx.com) but can dilute founders if too many tranches are used.

Angel investors remain the backbone. Canadian angels typically invest $25 k–$500 k per deal (angelspartners.com). They often provide mentorship, early customer introductions and social proof. Women‑led companies receive a smaller share of risk capital (around 13 % of government program recipients and ~21 % of early‑stage VC financings) (ised-isde.canada.ca, osler.com).

Government programs provide powerful non‑dilutive financing. IRAP reimburses 60–80 % of eligible R&D costs up to $500 k over 12–24 months (funding.ryan.com). SR & ED credits deliver $4.5 billion of ITCs annually with acceptance rates over 90 % (canada.ca). Futurpreneur loans and BDC programs target youth and specialized groups (hellodarwin.com).

Prepare a tailored pitch deck. A strong deck should articulate the problem, solution, market opportunity, competitive landscape, business model, traction, financials and funding ask (rbcx.com). Pre‑seed investors value clarity of vision and proof of problem–solution fit more than detailed financial projections (rbcx.com).

Due diligence is deeper and timelines are longer. After the 2023–24 market correction, investors conduct extensive diligence, require realistic valuations, and expect founders to plan 12 months ahead (betakit.com). Early‑stage financing now represents 45 % of deals but only ~23 % of dollars, underscoring the competitive environment (osler.com_.

🛠 How Pre‑Seed Financing Works

1. Bootstrapping & Family/Friends (Pre‑seed)

Personal savings & sweat equity – Founder uses personal funds to build an MVP; retains complete control. No dilution but limited runway.

Family and friends – Early supporters invest on trust; formalize agreements via SAFEs or convertible notes to avoid legal issues. Keep valuations conservative and highlight milestones.

2. Angel Investors & Pre‑Seed Funds

Angel investors – High‑net‑worth individuals offering $25 k–$500 k per deal (angelspartners.com). Look for angels with sector expertise. Engage via local networks (e.g., National Angel Capital Organization (NACO) groups) and pitch events.

Micro‑VC and pre‑seed funds – Specialized funds invest CAD 250 k–1 M in exchange for 10–20 % equity. They seek strong teams, market validation and potential to raise a seed round. Many require use of SAFEs to simplify terms.

3. Accelerators & Incubators

Provide small investments (e.g., $25 k–$150 k) plus mentorship, workspace and industry connections. Examples include Techstars Toronto and Creative Destruction Lab. Accept ~1–5 % equity or convertible notes. Evaluate program fit and network strength.

4. SAFEs vs Convertible Notes

SAFE (Simple Agreement for Future Equity) No interest or maturity date; converts at next priced round using discount (5–20 %) or valuation cap (rbcx.com, rbcx.com). Post‑money SAFEs clarify ownership but can dilute founders if used excessively (rbcx.com).

Convertible Note - Debt instrument -Carries interest and maturity; may require repayment; converts to equity at maturity or next priced round (rbcx.com).

5. Government Grants & Tax Incentives

NRC‑IRAP – Supports R&D projects of Canadian SMEs with <500 employees. Can cover up to 80 % of labour and 50 % of subcontractor costs (srjca.com). Maximum funding typically $500 k over 12–24 months (funding.ryan.com).

SR & ED Tax Incentive – Federal program enabling businesses to claim investment tax credits (ITCs) for eligible R&D expenses. In fiscal 2024–25 there were 22,758 claims filed and $4.7 billion ITCs claimed (canada.ca). Refund rates and thresholds vary by company size but can reach 35 % for Canadian controlled private corporations (CCPCs).

Futurpreneur – For entrepreneurs aged 18–39; offers up to $20 k in unsecured loans with a potential $40 k match from BDC, mentorship and resources (hellodarwin.com, hellodarwin.com).

6. Seed Round (Optional) and Series A Preparation

Seed rounds in Canada average $2.23 M; some deals reach ~$5 M. Investors look for early revenue and product traction. Traction metrics (ARR, user growth) help command higher valuations.

Less than 10 % of seed‑funded companies progress to Series A (investopedia.com). Pre‑seed founders should design experiments to prove product–market fit and maintain investor updates.

📊 Data, Trends & Case Studies

Market Trends

Investment volumes: CVCA reported $1.97 M average seed deal size in 2024 and $2.23 M in H1 2025 (central.cvca.ca, central.cvca.ca). Pre‑seed/seed dollars declined 12–16 % year‑over‑year but deal sizes recovered, indicating investors concentrating capital into fewer companies.

Sector allocation: ICT accounted for ~50 % of seed investment dollars and AI captured about 10 % in H1 2025 (central.cvca.ca).

Provincial distribution: Ontario led pre‑seed/seed funding with $16.4 M across 18 deals and an average deal size of $0.91 M in H1 2025 (central.cvca.ca); Quebec and Alberta followed.

Founder demographics: Women‑led companies represented ~21 % of financings but only 12 % of capital in 2024 (osler.com); government program recipients with women principals were 13.7 % (ised-isde.canada.ca).

📈 Case Examples of Pre-Seed Funding in Canada

Clio (2024) — Series F (~CAD 1.24 billion)

Vancouver-based legaltech leader Clio closed a landmark Series F round in 2024, raising roughly CAD 1.24 billion in a deal led by New Enterprise Associates and TCV (source: betakit.com).

The transaction demonstrated that even in a more cautious venture environment, mega-deals are still achievable for category leaders.

It also highlights an important dynamic for early investors — if they don’t participate pro rata in later rounds, their ownership stakes can be heavily diluted as institutional investors consolidate control in large financings.

AI Start-up Example (Hypothetical) — Pre-seed (~CAD 0.8 million)

A hypothetical early-stage AI company raised about CAD 800 000 using a post-money SAFE with a 20 percent discount and a $6 million valuation cap.

The founders paired this raise with a contribution from the NRC IRAP Program, which reimbursed roughly 80 percent of R&D salary costs (source: srjca.com).

This mix of dilutive (SAFE) and non-dilutive (IRAP) capital allowed the team to speed up technical progress while preserving equity — a textbook example of capital efficiency in Canada’s innovation ecosystem.

Futurpreneur-Supported Founder — Pre-seed (~CAD 50 000 in loans)

One Canadian founder launched with a $20 000 loan from Futurpreneur and an additional $30 000 top-up from BDC(source: hellodarwin.com).

The five-year, low-interest structure combined with Futurpreneur’s mentorship program helped the entrepreneur build a minimum viable product (MVP) and later secure an IRAP grant.

It’s a strong case for using government-backed debt to bridge the gap between idea and investable traction without giving up early equity.

🇨🇦 Canadian Angle: Programs & Capital Stack

NRC IRAP — Grant / Contribution

The Industrial Research Assistance Program (IRAP) from the National Research Council provides non-repayable contributions covering up to 80 percent of direct labour costs and 50 percent of subcontractor expenses for eligible R&D projects (sources: srjca.com; funding.ryan.com).

Typical funding caps reach around $500 000 over 12 to 24 months. The program targets Canadian SMEs (with fewer than 500 employees) developing new technologies or process innovations. Applications are reviewed on a competitive basis, so early preparation and clear technical objectives are key.

SR & ED — Tax Credit Program

Canada’s Scientific Research and Experimental Development (SR & ED) program provides refundable or non-refundable Investment Tax Credits for eligible R&D work.

In FY 2024–25, the CRA reported 22 758 claims worth $4.7 billion (source: canada.ca).

Companies can also layer in provincial SR & ED credits to increase total benefits. For founders, it’s a cornerstone tool to extend runway while keeping control of the cap table.

Futurpreneur + BDC — Debt (Loan)

Through a joint program between Futurpreneur and the Business Development Bank of Canada, founders aged 18 to 39 can access up to $20 000 in Futurpreneur financing and a matching $40 000 loan from BDC (source: hellodarwin.com).

The loans carry five-year terms with interest rates below prime and include structured mentorship and planning support. Applicants must submit a business plan and cash-flow forecast, and special streams exist for Indigenous, newcomer, and women entrepreneurs.

Angel Groups (e.g., NACO) — Equity

Angel investors organized under the National Angel Capital Organization (NACO) umbrella typically invest through SAFE agreements or convertible notes. Individual cheques range from about $25 000 to $500 000 (source: angelspartners.com).

Such investors favor founders with demonstrable traction and strong referrals from their network — making community building and warm introductions vital at the pre-seed stage.

Accelerators (e.g., CDL, Techstars, Next 36) — Equity / Note

Prominent Canadian accelerators such as Creative Destruction Lab (CDL), Techstars, and Next 36 offer $25 000 to $150 000 in funding for 1 to 5 percent equity or via convertible notes. Beyond capital, they provide mentorship and access to investor and corporate networks. Admission is competitive and skews toward scalable, high-growth technology ventures with coachable founding teams.

Key Players

Venture Funds: Version One Ventures, Panache Ventures, Inovia Capital (seed/Series A), Real Ventures, Golden Ventures. Many have dedicated pre‑seed vehicles or scout programs.

Government Agencies: National Research Council (IRAP), Canada Revenue Agency (SR & ED), Business Development Bank of Canada (BDC), Regional Development Agencies (e.g., FedDev Ontario). These bodies deliver grants, loans and tax credits.

Community & Ecosystem: MaRS Discovery District (Toronto), Notman House (Montreal), Platform Calgary, Volta (Halifax). They host networking events, workshops and acceleration programs.

🏁 Bottom Line

Pre‑seed capital in Canada is precious: average deal sizes hovered around $2.23 M in early 2025, but total pre‑seed/seed dollars continue to decline (central.cvca.ca, betakit.com).

Leverage flexible instruments and programs: SAFEs and non‑dilutive support (IRAP, SR & ED, Futurpreneur) can extend runway and minimize dilution (rbcx.com, srjca.com_.

Prepare for thorough diligence: investors expect clear problem‑solution fit, strong teams and realistic valuations; seed to Series A conversion rates remain below 10 % (investopedia.com).

Prioritize diversity and regional expansion: only ~21 % of financings go to women‑led companies (osler.com), and support for under‑represented founders is essential.

Canadian founders can succeed: by combining private investment, government programs and strategic planning, pre‑seed startups can secure the capital needed to validate their ideas and position for growth.

Raising pre-seed capital in Canada isn’t about chasing big numbers — it’s about proving you can build momentum with limited resources and smart partnerships.

The founders who win at this stage aren’t always the loudest; they’re the ones who mix just enough equity with well-timed non-dilutive funding, know their numbers, and keep investors in the loop as they learn fast.

Whether you’re starting with a SAFE, a Futurpreneur loan, or a mix of both, the goal is the same: buy time to validate your idea, stay lean, and line yourself up for a clean, confident seed round.

If you found this guide helpful, please check out our other free Canadian Business guides.

Risk Disclaimer and Intended Use: This guide is intended to act as an educational resource, - not a definitive recommendation. Please reference underlying sources directly for further details. This guide is not a recommendation to raise capital from investors, US-based or otherwise. If you need advice for your business, you are welcome to contact us for a referral.