What Your Company Is Worth to Private Equity: A Canadian Guide

Learn how private equity values Canadian businesses. Understand EBITDA multiples, quality of earnings, industry trends, and strategies to maximize your company’s worth.

🔍 Executive Summary

This guide demystifies how private equity firms value companies, the key drivers of deal multiples, and how Canadian businesses can prepare for a PE sale.

Readers will learn the fundamentals of EBITDA-based valuation, why quality of earnings matters, current market multiples across sectors, and how to position their business for maximum value in today’s evolving investment landscape.

🧩 Context & Why PE Firms Matter

Private equity (PE) firms play a pivotal role in the Canadian economy. With baby boomers set to transfer over CAD $1 trillion of wealth between 2023‑2026 (bdo.ca), many mid‑market businesses will soon change hands.

PE activity in Canada remains robust: Q1‑2025 deal value reached approximately $113.7 billion, a 70% year-over-year increase (businesslawtoday.org).

However, buyers are cautious about geopolitical risk, talent shortages and earnings quality (bdo.ca). For owners contemplating a sale, understanding how PE funds evaluate opportunities is vital.

💡 Key Insights About PE Firms:

PE firms buy for growth and efficiency. They target businesses with stable cash flows, strong margins and clear paths to EBITDA expansion. After all, operational improvements can unlock significant value (bdo.ca).

Quality of earnings drives valuation. A quality of earnings (QoE) report distinguishes recurring from non‑recurring revenue, scrutinizes working capital and pinpoints sustainable earnings (bradyware.com). There are no universal standards, so buyers and sellers must align on scope (cbvinstitute.com).

Multiples vary widely. In Canada, typical EBITDA multiples range 4.5–8×, with tech firms commanding 10–15×and manufacturing businesses 3–5× (windsordrake.com). Smaller firms (EBITDA < CAD $2 M) often trade around 4×, while larger companies can command 6–10× (windsordrake.com).

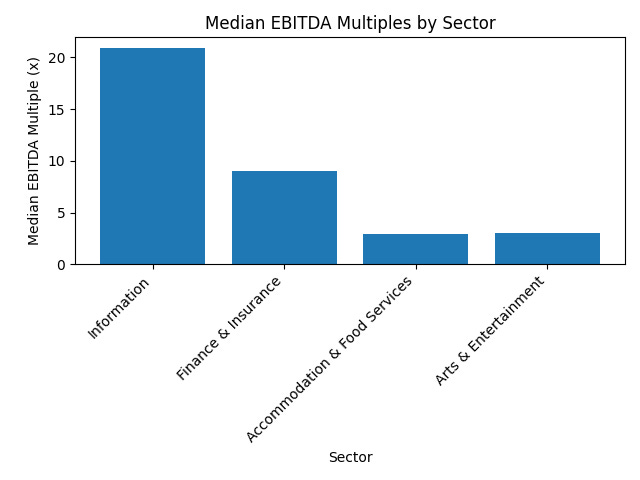

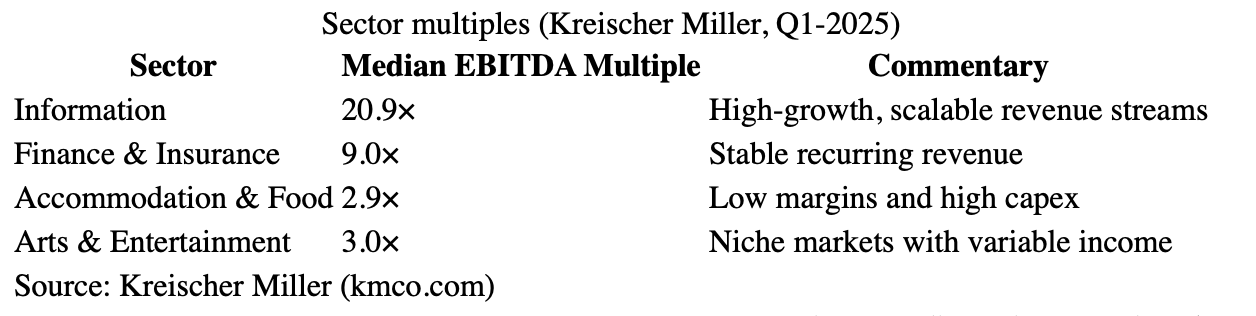

Industry matters. Recent U.S. private-company data show median multiples ranging from 2.9× for accommodation and food services to 20.9× for information services (kmco.com). Sector growth rates and capital intensity heavily influence valuation.

Management and growth potential are critical. PE firms seek experienced and financially committed teams, proven business models and scalable growth prospects (conseroglobal.comcafafinance.com).

Exit strategy and strategic fit. Investors assess whether the business can be sold at a higher multiple after operational improvements (multiple expansion), or combined with add‑on acquisitions (cafafinance.com).

Macro headwinds influence pricing. Interest rates, capital gains tax changes and geopolitical uncertainty can compress multiples. Canada’s lifetime capital gains exemption for qualifying shares increased to $1.25 million in 2024 (skylinewealthmanagement.ca), improving after-tax sale proceeds.

🛠 How Private Equity Values You

Prepare a quality of earnings analysis. Identify recurring revenue, adjust for one-off items (e.g., pandemic subsidies or lawsuit settlements), and estimate normalized EBITDA. Evaluate working-capital requirements (bradyware.com).

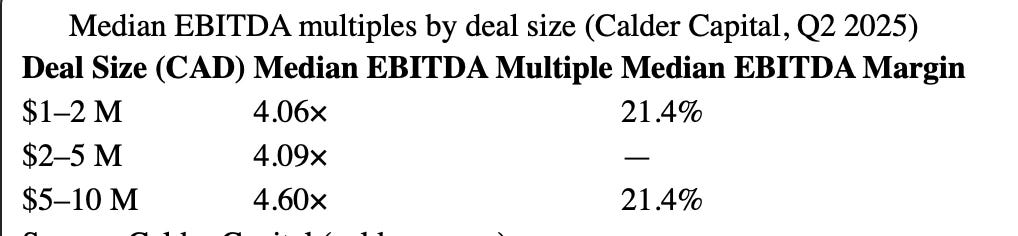

Benchmark against market multiples. Compare normalized EBITDA with recent transactions in your industry and size bracket. For instance, Calder Capital’s Q2‑2025 data shows median EBITDA multiples around 4.06× for deals between CAD $1–2 M, rising to 4.6× for $5–10 M deals (caldergr.com).

Assess margins and growth. Higher gross margins, low capital expenditures and recurring revenue justify higher multiples. Demonstrate a robust pipeline and well-documented growth plan (conseroglobal.com).

Consider adjustments. Deduct non-operating assets and add back normalized owner salaries. Subtract debt and add cash to derive equity value.

Structure the deal. Decide whether to sell a majority or minority stake. PE investors often require management to roll over 10–30% equity to ensure alignment (cafafinance.com).

Conduct due diligence. Buyers analyze operations, technology, legal and tax risks, customer concentration, and environmental factors. A well-prepared data room and transparent disclosure reduce execution risk.

Negotiate terms. Beyond price, consider earn-outs, seller financing and employment agreements. Skilled advisors can create competitive tension and maximize outcomes.

📊 Data & Trends For Private Equity Acquisitions

Below is a visualization of sector-specific EBITDA multiples drawn from Kreischer Miller’s private-company M&A data (kmco.com). Technology and information services command premium valuations, while sectors like accommodation and food services trade at lower multiples.

🧭 Strategy Playbook to Prepare for a PE Pitch

For Founders

Build a strong management bench. Recruit experienced leaders and delegate effectively. A committed management team is often non‑negotiable for PE buyers (conseroglobal.com).

Drive consistent margins. Improve operational efficiency, reduce customer concentration, and standardize processes. Small improvements in EBITDA can significantly increase valuation (bdo.ca).

Document growth opportunities. Present a clear, data-driven growth plan (organic or through add‑on acquisitions). Highlight your competitive moat, customer stickiness and scalability (cafafinance.com).

Prepare for due diligence early. Organize financial statements, contracts and compliance documents. Engage advisors to conduct a QoE and tax review. Transparent disclosure builds buyer confidence.

For Investors

Target high-quality earnings. Favour businesses with predictable cash flows, recurring revenue and low working-capital needs (conseroglobal.com).

Leverage operational value creation. Identify cost synergies, pricing opportunities and technology upgrades. The BDO survey notes that operational improvements are essential for PE returns (bdo.ca).

Consider minority deals. Canadian funds like BDC Growth Equity Partners invest $3–$45 million as minority stakes up to 49% (bdc.ca), offering growth capital without full buyout risk.

For Policymakers

Encourage investment vehicles. Expand programs like the Canada Growth Fund (CGF), a $15 billionarm’s‑length entity that invests in projects, clean technology and low-carbon supply chains to attract private capital and reduce emissions (cgf-fcc.cacgf-fcc.ca).

Support SME succession. Many business owners lack succession plans. Incentives or advisory programs could help them navigate PE transactions.

Maintain tax competitiveness. Policy stability around capital gains and investment incentives can bolster PE activity. The 2024‑25 LCGE increase to $1.25 million aids entrepreneurs exiting a business (skylinewealthmanagement.ca).

🇨🇦 Canadian Angle

Federal & Provincial Private-Equity Style Programs

BDC Growth Equity Partners: Since 2017, BDC has managed capital pools totalling ~$900 million and is investing from Growth Equity Partners Fund III—a $300 M fund launched in 2024 (bdc.ca). They provide equity investments from $3–45 million, taking up to 49% stakes in established, profitable mid‑market firms with proven models, committed management and stable positive cash flows (bdc.ca).

Canada Growth Fund (CGF): A $15 billion independent fund managed by CGF Investment Management (a subsidiary of PSP Investments). CGF invests to unlock private sector capital in Canadian projects, clean technology and low‑carbon supply chains, aiming to reduce emissions and accelerate innovation (cgf-fcc.cacgf-fcc.ca). It employs equity, debt and hybrid instruments (cgf-fcc.ca) and emphasizes additionality, long-term benefits for Canada and sustainabilitycgf-fcc.ca.

Canadian Business Growth Fund (CBGF): Backed by leading banks and insurers, CBGF provides minority capital to growth-stage companies. The fund has capital commitments of $545 million and offers long-term, patient capitalcbgf.com.

🇨🇦 Major Canadian Private Equity Players

Canada’s private equity landscape is anchored by a mix of global powerhouses, established mid-market specialists, and emerging thematic investors driving growth across infrastructure, technology, and manufacturing.

Brookfield Asset Management stands at the top of the list, managing nearly $1 trillion in assets worldwide. It is a global leader in infrastructure, real estate, and renewable energy, with a reputation for long-term stewardship and operational excellence.

Onex Corporation, with approximately CA$50 billion AUM, is one of Canada’s most prominent buyout and growth equity firms. Onex has completed major transactions across North America — including its notable acquisition of WestJet — and remains focused on long-horizon investments in established operating companies.

Northleaf Capital Partners manages both infrastructure and private equity mandates, having recently raised $2.6 billionfor its Infrastructure Capital Partners IV fund. The firm focuses on mid-sized deals, providing flexible capital to growing infrastructure and PE-backed businesses.

Novacap, with $3.6 billion AUM, specializes in buyouts and growth equity, often working hand-in-hand with management teams to accelerate expansion and improve operational performance.

Georgian takes a more specialized approach, investing $20 million to $50 million in software and AI companies. Known for its data-driven investment model and partnership philosophy, Georgian plays a leading role in scaling Canada’s technology sector globally.

Sagard PE Canada targets mid-cap opportunities in financial services and manufacturing, blending traditional private equity discipline with a flexible, long-term capital base.

Cordiant Capital, managing about $3.4 billion, channels capital into infrastructure and agriculture, with a particular focus on essential assets that underpin global economic resilience.

Fengate has become a key infrastructure and private equity player, recently taking a majority stake in eStruxture Data Centers for $1.3 billion. The firm actively invests across energy, digital infrastructure, and real assets.

Ethical Capital Partners, best known for its acquisition of Aylo (formerly MindGeek), brings a new lens to Canadian PE with a focus on responsible ownership, governance, and social impact in sensitive industries.

Finally, CPP Investments — Canada’s sovereign investment fund — operates on a global scale, holding significant stakes in major firms such as Petco and Neiman Marcus. With hundreds of billions under management, it remains a cornerstone of institutional capital both domestically and abroad.

Tax Considerations

Lifetime Capital Gains Exemption (LCGE): Increased to $1.25 M for qualifying small business shares, farms and fisheries for dispositions on or after June 25 2024, - this is an important consideration for business owners (skylinewealthmanagement.ca).

Capital Gains Inclusion Rate: After proposing to raise the inclusion rate from 50% to 66.67%, the government deferred the change to 2026 and ultimately cancelled it in March 2025 to stimulate investment (skylinewealthmanagement.ca).

🏁 Bottom Line

Valuation hinges on normalized EBITDA and market multiples. Understand your earnings quality and benchmark against comparable deals.

Strong management and scalable growth drive higher multiples. Demonstrate clear expansion plans, defendable market position and stable cash flows.

Prepare early for due diligence. A robust data room and QoE report reduce surprises and improve negotiating power.

Leverage Canadian capital sources. Funds like BDC Growth Equity Partners and CGF provide non‑dilutive growth capital and strategic support.

Monitor tax and macro trends. Changes to capital gains rules and economic conditions can materially impact deal pricing and net proceeds.

Risk Disclaimer and Intended Use: This guide is intended to act as an educational resource, - not a definitive recommendation. Please reference underlying sources directly for further details. This guide is not a recommendation to raise capital from investors, US-based or otherwise. If you need advice for your business, you are welcome to contact us for a referral.