The Canadian Founder’s Cap Table Guide

Learn how Canadian founders can build cap tables, manage dilution, and leverage SR&ED and IRAP to preserve equity. Includes templates and case studies.

🔍 Executive Summary

A cap table (or capitalization table) is the ledger that shows who owns what in a company and how that ownership evolves as the business grows.

For Canadian founders, managing the cap table is not just record‑keeping—it is a strategic tool for fundraising, talent retention, and navigating dilution.

This guide explains how cap tables work, why dilution happens, and how ownership changes through successive funding rounds.

It offers AI‑generated templates to model scenarios, highlights data and case studies, and points to Canadian programs such as SR&ED and IRAP that can help founders minimize dilution.

Whether you are preparing for your first funding round or planning a Series B, understanding your cap table will help you negotiate with investors, design employee stock option plans, and maintain control of your company.

🧩 Context & Why Cap Tables Matter

Cap tables begin simply; two co‑founders might split a business 50/50 (rbcx.com). Once the company raises capital or issues stock to employees, the ledger must be updated (rbcx.com).

Each new round adds complexity—stock options, convertible notes, SAFEs, preferred shares, and anti‑dilution provisions all influence who owns what (eqtgroup.com).

Poorly maintained cap tables can lead to unexpected dilution when convertible instruments convert into equity and can be red flags for investors: dead equity, uneven founder splits, or advisor ownership (rbcx.com).

For Canadian founders, cap table management is especially relevant because non‑dilutive funding like SR&ED tax credits and IRAP grants can reduce reliance on equity financing (rbcx.com) and preserve ownership.

In a global funding environment where valuations fluctuate, understanding dilution and the timing of rounds is critical to retaining control and maximizing value.

🛠 How Cap Tables Work

Building and maintaining a cap table involves a structured process. The following steps outline how founders can create a cap table from scratch and update it through each funding round.

1. Establish the framework

Collect foundational documents. Gather incorporation documents, share certificates, option grants, convertible note agreements, and any SAFE documentation (eqvista.com). These materials specify authorized shares and rights.

Set up your spreadsheet. At minimum, include columns for shareholder name, security type (common, preferred, option, warrant, SAFE/convertible note), number of shares or units, percentage ownership, and class or series (stripe.com).

Include authorization and allocation lines. The first rows should show total authorized shares, issued shares, and unissued shares (eqvista.com). This ensures you do not issue more than is authorized.

2. Populate the current ownership

List founders and early investors. Record how many common shares each founder owns. For example, a simple cap table might have two founders each owning 500 shares (50 % each - rbcx.com). If a VC purchases 20 % of the company for cash, update the table: each founder owns 40 %, and the VC owns 20 % (rbcx.com).

Add convertible instruments. SAFEs and convertible notes should not be omitted simply because they have not yet converted. RBC warns that neglecting these instruments can cause unexpected dilution; include them with fields for amount invested, valuation cap, and discount so you can model conversion later (rbcx.com).

Define the option pool. Allocate an ESOP/VSOP pool (10–20 % of fully diluted equity) and show both granted and ungranted options. For example, a 15 % pool might reserve 5 % for future executives, 5 % for other key hires, and 5 % for broader employees and advisors (learn.marsdd.com).

3. Calculate ownership and dilution

Compute fully diluted shares. Sum all shares, options, and convertible instruments (assuming conversion) to determine fully diluted equity (indexventures.com). Divide each shareholder’s holdings by the fully diluted total to obtain percentage ownership.

Model new rounds. When raising capital, create a pre‑financing and post‑financing cap table to show the dilutive impact. Clarify whether the investor’s percentage is pre‑money or post‑money and whether the option pool is calculated before or after the investment (learn.marsdd.com).

Incorporate anti‑dilution adjustments. Preferred shares often include anti‑dilution clauses that adjust conversion ratios if new shares are issued at lower prices (learn.marsdd.com); update conversion ratios when applicable.

4. Update continuously

Record every transaction. Each share issuance, option grant, exercise, expiry, or buy‑back should trigger an update (learn.marsdd.com).

Review convertible instruments regularly. Model scenarios for conversion and ensure you understand how many shares will be issued when notes or SAFEs convert (rbcx.com).

Communicate with stakeholders. Provide investors and employees with updated cap tables. Transparent reporting builds trust and prepares everyone for the next funding event.

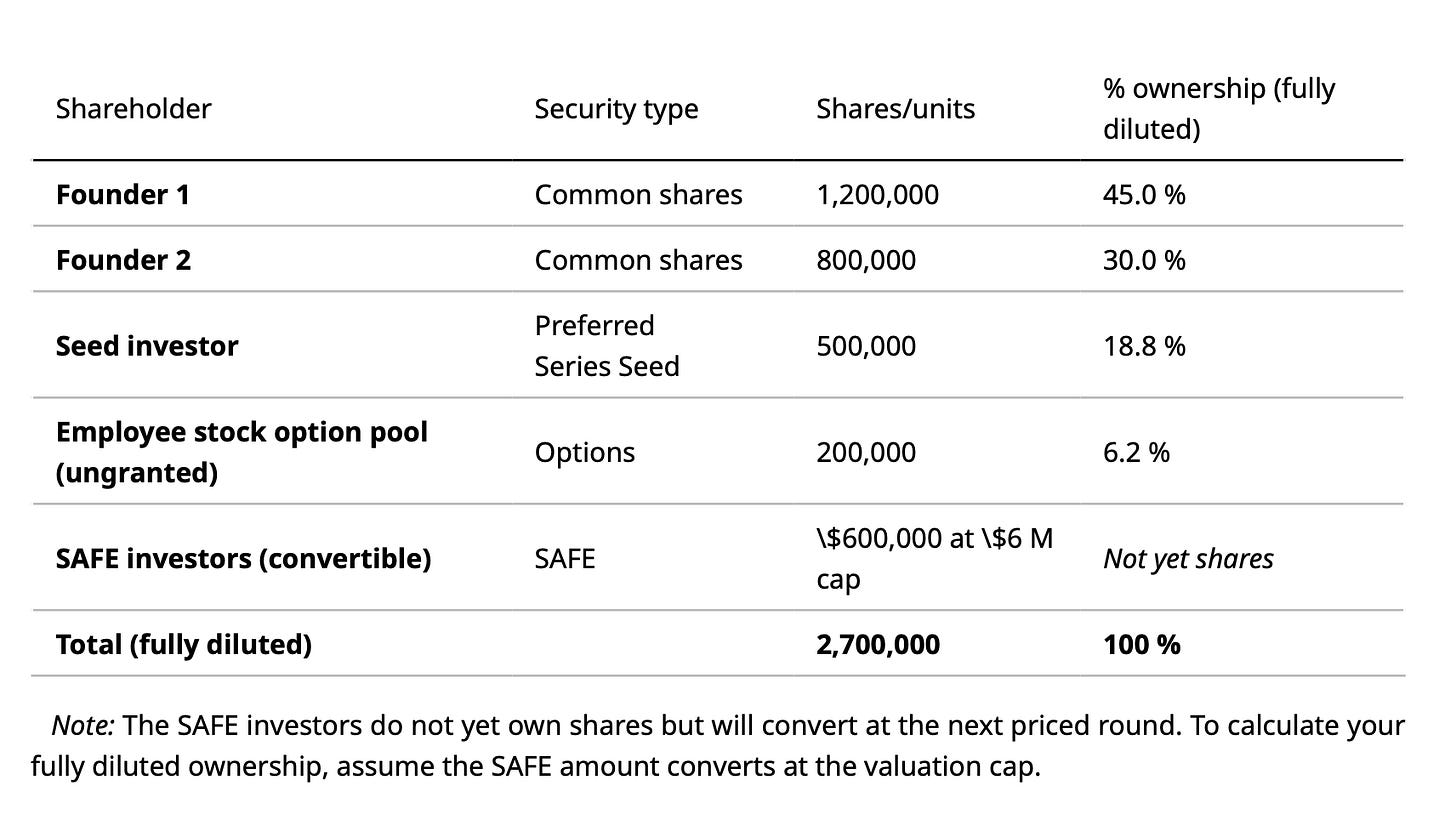

📄 Sample Cap Table Template (post‑seed example)

Below is a simplified table template. Replace numbers with your own data and update as you issue new shares or options.

📊 Data, Trends & Case Studies

📈 Funding round benchmarks

Primary research by Index Ventures offers typical ranges for early rounds.

Pre‑seed rounds often raise US$1–3 M at valuations of US$5–15 M;

Seed rounds raise US$3–8 M at valuations of US$10–25 M;

Series A rounds raise US$8–15 Mat valuations of US$25–60 M (indexventures.com).

Headcount generally grows from a small founding team to dozens of employees by Series A (indexventures.com). These benchmarks can help Canadian founders gauge expectations and negotiate with investors.

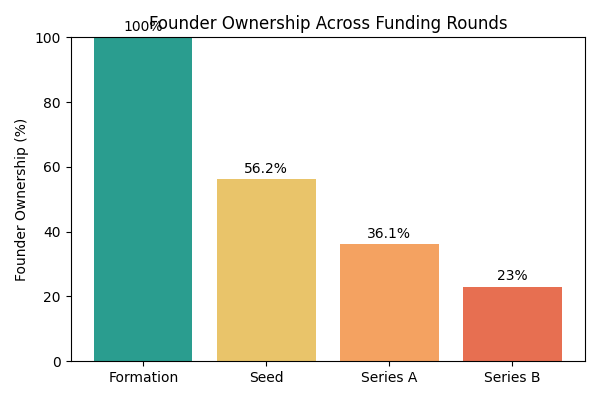

📉 Dilution through rounds

The founder ownership chart below visualizes how ownership changes through major funding stages (formation, seed, Series A, Series B).

Data from Carta’s 2025 report shows a steep decline—from 100 % at incorporation to 56.2 % after a seed round, 36.1 % after Series A, and just 23 % after Series B (carta.com).

This trajectory underscores why cap table planning is crucial.

📚 Case studies and examples

Equity dilution example: Morgan Stanley illustrates that equity dilution occurs whenever new shares are issued.

A founder who owns 100 % of a company with 100 shares sells 25 new shares to a new investor; after issuance, the founder still owns 100 shares but their stake falls to 80 % (100/125).

Even though their ownership percentage shrinks, if the valuation rises (e.g., from $2 million to $2.5 million), the founder’s stake can still be worth $2 million (morganstanley.com).

Series A dilution scenario:

Eqvista’s example starts with four founders each owning 25 % of the company. After issuing 200,000 shares to four investors in a Series A, each founder’s stake falls from 25 % to 21 % while each investor owns 4 % (eqvista.com).

The example demonstrates how a modest infusion of capital can meaningfully dilute founders.

SAFE conversion impact:

In RBC’s example, a company raises $750 k on a $5 million post‑money SAFE (SAFE holders entitled to 15 % of the company).

The next seed round raises $2 million at a $10 million post‑money valuation (20 % to new investors).

When the SAFE converts, the founders experience more dilution than anticipated because both the SAFE and seed investors dilute them (rbcx.com).

This case highlights the importance of modelling convertibles.

ESOP top‑ups:

Index Ventures compares ESOP top‑up sizes at Series A (10 %, 15 %, 20 %).

With a 10 % option pool, founder ownership might fall from 65 % to 47 %; with a 20 % pool, it drops to 40 % (indexventures.com).

The larger the pool, the more dilution founders absorb, but a bigger pool may be necessary to attract talent.

🧾 Common cap table errors for founders

Not updating regularly: MaRS warns that failing to track option grants, exercises and expiries leads to inaccurate tables (learn.marsdd.com).

Misunderstanding pre‑ vs. post‑money valuations: Founders should clarify whether an investor’s percentage refers to pre‑ or post‑money and whether the option pool is topped up before or after the investment (learn.marsdd.com).

Ignoring anti‑dilution adjustments: Preferred shares often include anti‑dilution clauses (learn.marsdd.com); forgetting to adjust conversion ratios can distort ownership projections.

Neglecting convertibles: RBC emphasizes that convertible instruments should be included in the cap table to avoid surprises (rbcx.com).

🧭 Strategy Playbook

For founders

Model dilution early and often. Use scenario analysis to estimate how much equity you will retain at future rounds. Include SAFEs, convertible notes, option pools, and anti‑dilution adjustments (rbcx.comindexventures.com).

Plan your ESOP strategically. Start with 10–20 % of fully diluted equity and top it up at each round. A 15 % pool might reserve 5 % for future executives and 5 % for key hires (learn.marsdd.com).

Negotiate term sheets carefully. Understand how investor protections (e.g., preferred shares, liquidation preferences, anti‑dilution provisions) affect your outcome (eqtgroup.com). If possible, seek a weighted‑average anti‑dilution instead of full‑ratchet to balance interests.

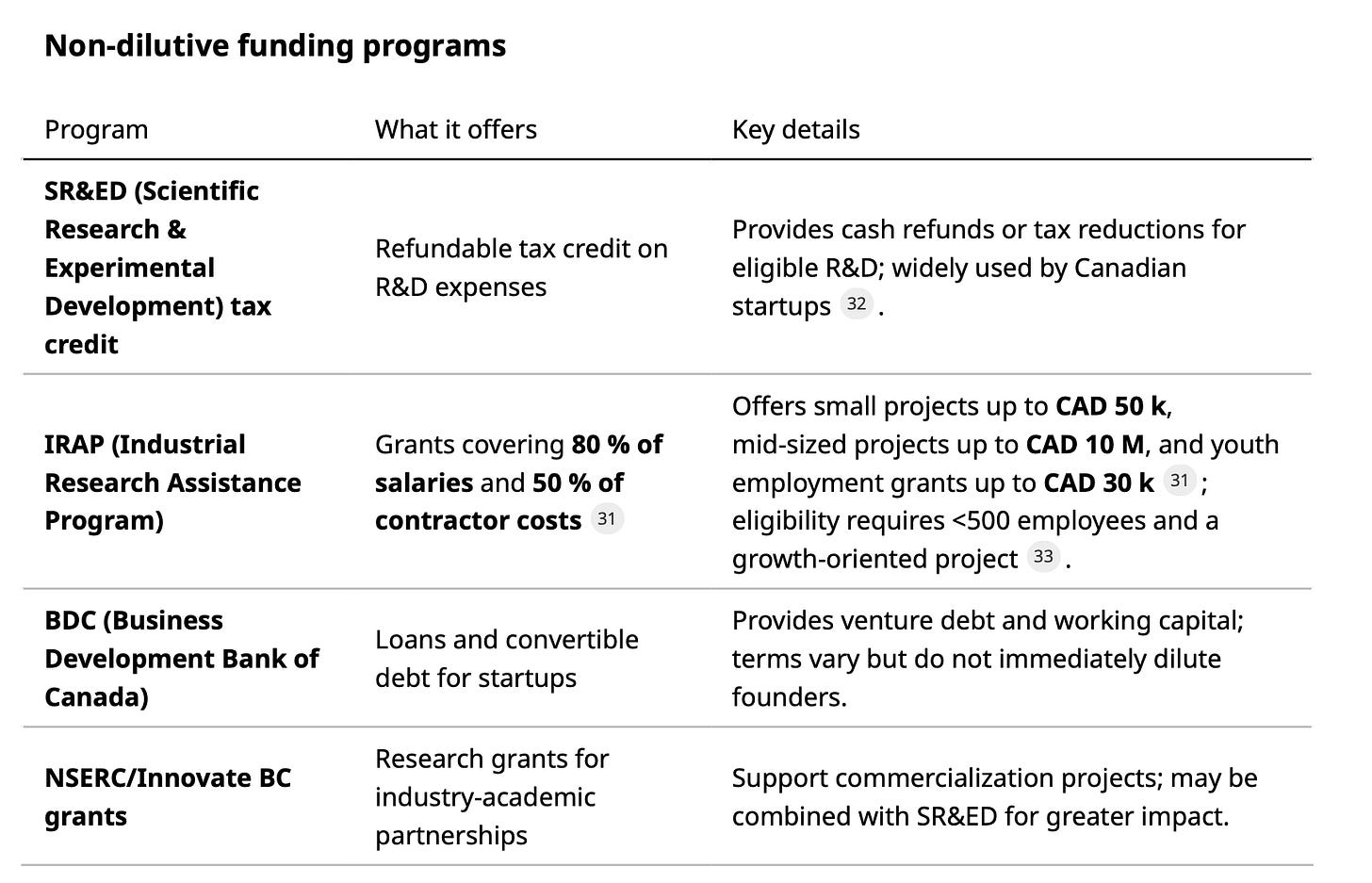

Leverage non‑dilutive funding. Canadian programs like SR&ED tax credits and IRAP grants provide capital without giving up equity (rbcx.com). Maintain a clean cap table by supplementing VC funding with grants, tax credits and low‑interest loans.

Avoid red flags. Vest equity for founders to prevent dead equity, agree on equal or fair splits, and be cautious about giving advisors large stakes (rbcx.com).

Seek legal and tax advice. The CRA’s rules on employee stock options mean that there is no tax when options are granted; tax is triggered on exercise, and only $200,000 of options can qualify for the stock‑option deduction each year (canada.ca). Ensure your plan complies with these rules.

For investors

Scrutinise the cap table. Look for red flags such as dead equity, odd advisor stakes, or excessive option pools (rbcx.com).

Encourage realistic modelling. Ask founders to provide cap table scenarios including convertibles and ESOP top‑ups (rbcx.com).

Support balanced terms. Anti‑dilution provisions should protect your investment but not cripple founders. Weighted‑average formulas are generally fairer than full‑ratchet (eqtgroup.com).

For policymakers

Expand non‑dilutive funding. Programs like IRAP, SR&ED, and provincial innovation funds reduce dependence on VC and preserve founder equity (rbcx.comboast.ai).

Standardise ESOP rules. Clear guidelines on option pool sizes and taxation (e.g., the $200 k deduction limit) make it easier for startups to plan (canada.ca).

Educate founders. Provide resources and workshops on cap table management through organizations like MaRS and RBCx (learn.marsdd.comrbcx.com).

🇨🇦 Canadian Angle

Canada offers unique programs and tax incentives that influence cap table strategy. Understanding these can help founders minimize dilution and attract talent.

💰 Tax and ESOP considerations

Employee Stock Options: The CRA notes that there is no tax consequence when options are granted. Tax is triggered when employees exercise their options and may qualify for a 50 % deduction if the annual vesting does not exceed $200,000 in fair‑market value (canada.ca). Founders should design vesting schedules accordingly.

ESOP size and allocation: MaRS suggests ESOP pools of 10–20 % of the company; negotiation is necessary because these shares dilute existing owners (learn.marsdd.com). For a 15 % pool, a rule of thumb reserves about 5 % for a future CEO or executive team replacement and 5 % for other executives. Founders typically receive options only in later rounds.

Convertible instruments: SAFEs and convertible notes are increasingly popular in Canada; RBC advises founders to include them in cap tables even before conversion (rbcx.com).

Valuation and market context: Canada’s venture market is smaller than the US, which may lead to lower valuations. Combining dilutive and non‑dilutive sources (grants, tax credits, venture debt) can help founders reach milestones without excessive dilution.

🏁 Bottom Line

• Cap tables are living documents. They must be updated whenever shares, options, or convertible instruments are issued (stripe.com) and should include all securities, even SAFEs and notes (rbcx.com).

• Expect dilution but plan for it. Founder ownership typically falls from 100 % at formation to about 56 % after seed, 36 % after Series A, and 23 % after Series B (carta.com). Modelling scenarios and negotiating valuations and option pools can mitigate the impact.

• Size your option pool thoughtfully. ESOPs usually represent 10–20 % of the company; larger pools attract talent but dilute founders. Replenish the pool at each round and follow allocation best practices (learn.marsdd.com).

• Use non‑dilutive financing to preserve ownership. Programs like SR&ED and IRAP provide funding without giving up equity (rbcx.comboast.ai). Combining grants, tax credits, and venture debt can reduce reliance on dilutive equity rounds.

• Maintain transparency and avoid red flags. Dead equity, uneven founder splits, and large advisor stakes signal misalignment (rbcx.com). A clean, regularly updated cap table builds trust with investors and employees.

In the end, a well-managed cap table is both a mirror and a map—it reflects where your company stands today and charts where it can go next.

Whether you’re an early-stage founder dividing equity with a co-founder, a scale-up CFO modelling dilution ahead of a Series B, or an investor evaluating ownership alignment, precision in your cap table builds trust and clarity.

As the data from Carta, Index Ventures, and RBCx shows, dilution is not defeat—it’s a natural exchange of ownership for momentum. The founders who succeed are those who treat equity like strategy, not math: they anticipate future rounds, design option pools to attract top talent, and understand the trade-offs embedded in SAFEs, notes, and preferred terms.

In Canada’s evolving venture landscape—where access to capital is widening through both private and public programs—mastering your cap table isn’t just administrative hygiene; it’s a core competency of modern entrepreneurship.

Risk Disclaimer and Intended Use: This guide is intended to act as an educational resource, - not a definitive recommendation. Please reference underlying sources directly for further details. This guide is not a recommendation to raise capital from investors, US-based or otherwise. If you need advice for your business, you are welcome to contact us for a referral.