Private Equity in Canada: Activity and Key Players (2020–2025)

🔍 Executive Summary

Canada’s private equity (PE) market has swung from pandemic-era lows to record highs.

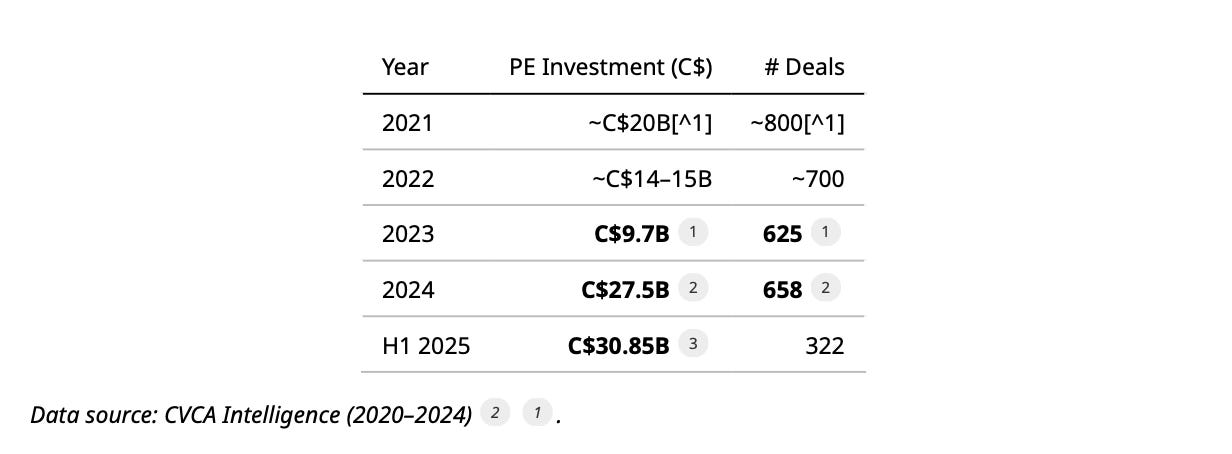

After a record low $9.7B invested in 625 deals in 2023 (fasken.com), activity exploded in 2024: $27.5B across 658 deals (intelligence.cvca.ca), and continued surging into 2025 with H1/2025: $30.85B in 322 deals (cvca.ca).

This rebound was driven by a few giant buyouts and tech/consumer deals – e.g. the C$6.3B Nuvei buyout and C$1.8B data-center deal (dwpv.com) – while mid-market SMEs still make up 84% of transactions (deals ≤$25M) fasken.com.

Leading sectors include ICT/tech, with over $15B in 2024 (intelligence.cvca.ca) and growing cleantech and consumer platforms.

Key domestic players range from pension-backed funds (FTQ, BDC, CDPQ, Investissement Québec) to homegrown PE sponsors (Onex, Northleaf, Altas, etc.), while U.S. firms (Thoma Bravo, Blackstone, etc.) have swooped on marquee targets, like Magnet Forensics at C$1.8B (betakit.com).

This report dives deep into these trends, data and implications, and lays out practical strategies for founders, investors and policymakers navigating Canada’s PE landscape.

🧩 Context & Why PE Investors Matter in Canada

Private equity is Canada’s engine of SME growth, and the market is in flux. After a pandemic-fueled boom in 2020–21, dealmaking stalled in 2023 due to higher interest rates and economic uncertainty (fasken.com).

However, cheap debt and pent-up demand have now ignited a wave of large transactions.

Globally, capital is flooding back into alternative assets, and Canada’s stable economy and tech talent pool make it a prime target. The recent U.S. regulatory tweaks and tighter investment screens, like the expanded Investment Canada Act reviews (central.cvca.ca) add complexity, but also protection for key sectors.

For entrepreneurs and investors, PE represents a path to scale and liquidity as public markets remain choppy (Canadian IPOs have all but dried up).

For policymakers, PE underscores how private capital fuels innovation and jobs – prompting new supports, like Canada Growth Fund, BDC late-stage funds (betakit.com) and debates on tax and trade policy.

Understanding the latest PE dynamics is critical for anyone shaping or riding Canada’s economic growth.

💡 Key Canada Private Equity Insights

🚀 Record Rebound: 2024–25 saw historic growth.

After $9.7B in 2023 (lowest on record) according to fasken.com, Canadian PE shot up to $27.5B in 2024 (intelligence.cvca.ca).

The trend continued: H1 2025 alone hit $30.85Bcvca.ca, already surpassing the full 2024 total. This surge was driven by a handful of mega-deals: seven $1B+ deals in 2024 that skewed totals (intelligence.cvca.ca) .

💰 Sector Winners: Technology and ICT dominated.

The ICT sector drew $15.3B in 2024 (intelligence.cvca.ca), accounting for over a third of PE dollars.

Cleantech (energy tech, sustainability) also saw a spike: C$1.2B in 2023 (fasken.com), a new record, as investors chase net-zero plays.

Consumer and retail platforms (C$4.1B in 2024 intelligence.cvca.ca) and select manufacturing or fintech deals rounded out the leader board. Sectors like life sciences and AI remain strategic focuses but with smaller deal counts to date.

📈 Deal Profiles: The great majority of PE activity is in the mid-market.

In 2023, 84% of deals were under C$25M (fasken.com), supporting homegrown SMEs.

Yet mega-buyouts now carry the market: buyout/add-on deals were only 28% of deals but 73% of dollars in 2024 (intelligence.cvca.caintelligence.cvca.ca.)

Average deal size hit an all-time low ~$15.5M in 2023 (fasken.com), but 2024’s average jumped with the big-ticket transactions.

🏙️ Regional Split:

Quebec led in volume, Ontario in value. Quebec accounted for 55% of deal count (344 deals, ~$4B) in 2023 (fasken.com), thanks to its strong tech and industrial base, while Ontario saw the largest capital deployed (~C$4.2B across 163 deals, and a few huge buyouts like Thoma Bravo’s Magnet Forensics deal betakit.com).

BC and Alberta have smaller PE scenes, BC: 67 deals, $458M; Alberta: 38 deals, $840M in 2023 (fasken.com). Toronto and Montreal remain the hotbeds of PE fundraising and deal-making.

🏗️ Exit Landscape: M&A is king; IPOs rare.

Exits picked up modestly: 86 exits, C$6.7B in 2024 (intelligence.cvca.ca), but nearly all were mergers or secondaries.

Only one PE-backed IPO has occurred since 2021 (in 2023) according to fasken.com. Most investors plan longer hold periods or sell to strategic buyers.

In 2024, privatizations (take-privates of public companies) alone hit $15.4B (intelligence.cvca.ca) – a record – reflecting high confidence in private ownership.

🌐 Key Players: A mix of domestic and global firms dominate.

Government-backed investors (Fonds de Solidarité FTQ, CDPQ, BDC Capital, Investissement Québec, etc.) together bookend much PE activity, alongside local PE firms (Onex, Northleaf, Altas, etc.).

U.S. mega-funds are active too – e.g., Thoma Bravo’s C$1.8B buyout of Magnet Forensics in 2023 (betakit.com) and other Silicon Valley investors in fintech and AI.

In H1 2025, Quebec’s CDPQ and FTQ led fund flows (together >$20B), underscoring how Canadian pension and union funds shape the market (intelligence.cvca.ca).

⚠️ Regulatory Climate: PE must navigate tighter rules. New competition and foreign investment laws (e.g. mandatory pre-closing filings, extended review windows (central.cvca.ca) may slow deals, especially in “sensitive” industries. Rising interest rates also make leverage harder. However, CVCA notes a policy push for growth-friendly frameworks; e.g. the federal Innovation and Growth strategy is being updated to keep capital at home (intelligence.cvca.cacentral.cvca.ca). Understanding these shifts is crucial – both founders and investors must plan deals that satisfy regulators and LPs alike.

🛠 How It Works

1. Fundraising & Fund Structure: PE firms (sponsors) raise capital from institutional LPs (pensions, endowments, family offices). Canada has dozens of funds each targeting segments (e.g. growth equity vs buyouts, core industries vs sector niches). Funds have finite lives (~10 years) and strive to invest most capital in 3–5 years. Prominent Canadian PE houses (Onex, Northleaf, Altas, etc.) manage multiple funds often in the $1–10B range, while many smaller funds (often co-investing) focus on C$10–50M deals. Government-linked investors (BDC Growth Equity, CDPQ, FTQ) operate their own PE platforms, sometimes co-investing or launching funds to fill market gapsbetakit.com.

2. Deal Sourcing & Due Diligence: PE scouts find targets through networks, bankers, or industry research.

Deals can be buyouts (acquiring control of mature firms) or growth/minority stakes in fast-growers.

Due diligence is rigorous: financial audits, market analysis, regulatory checks. Canadian PE has increasingly used “plans of arrangement” (court-supervised deals) and representations & warranties insurance to speed up closing, influenced by global practice (central.cvca.ca).

In tech and healthcare, buyers may agree to earnouts or collars to bridge valuation gaps – though 2023 saw a decline in aggressive earnouts.

3. Financing & Structure: Deals often blend equity (from the fund) and debt (bank loans or bond financing).

A typical buyout might involve 40–60% debt. High-cap rates in 2023–24 made debt financing more expensive, but recent Treasury yield declines have begun easing terms.

Sponsors also structure privatizations (taking public firms private via mergers) – a trend at record levels in 2024 (intelligence.cvca.ca).

Many Canadian deals incorporate government or co-investor support (e.g. BDC as co-investor) to bolster financing.

4. Value Creation: Post-deal, PE owners work with management to drive growth and efficiency – via tech upgrades, strategic acquisitions, or cost optimization.

PE owners generally push for stronger governance (e.g. new boards, KPIs) and often add sector expertise to their portfolio companies.

For founders, this means adopting PE-style reporting and milestones if seeking a deal.

According to CVCA, PE is increasingly targeting operational value creation (vs. financial engineering) to generate returns (central.cvca.ca, fasken.com).

5. Exits: The endgame is selling the stake at a profit.

In Canada, most exits are to strategic buyers or other PE firms. IPOs are uncommon (zero in 2024 - intelligence.cvca.ca), so PE-backed companies often stay private or are sold to corporates.

Notable exit routes: trade sale (e.g. Nutanix selling to private buyer), secondary buyout (one PE fund selling to another), or recapitalizations for liquidity.

As one law firm notes, M&A accounted for ~74–77% of exits recently (intelligence.cvca.ca). Founders and LPs should prepare for longer holds and M&A exits rather than expecting a quick stock market listing.

📊 Data, Trends & Case Studies

Annual Totals: 2020–22 was a boom period (for context, CVCA reported all-time highs in 2019 and 2021). After a retreat in 2023 - the owest deal count/value on record (fasken.com), 2024 smashed records. The chart below illustrates:

Sector Breakdown: 2024 highlights how tech and consumer dominated dollars. The ICT sector grabbed $15.3B (intelligence.cvca.ca ), like Magnet Forensics, cybersecurity, SaaS companies, while consumer/retail (e-commerce, food & beverage, healthcare) drew $4.1B (intelligence.cvca.ca). In H1 2025, automotive/transport was surprisingly top ($3.4B, thanks to a few large deals ()cvca.ca).

Notable Deals: Case studies illustrate the market:

Magnet Forensics – Thoma Bravo (Jan 2023): Canadian cyber-forensics firm taken private for C$1.8B (betakit.com). This large tech buyout (15% premium over market) signals huge U.S. PE interest in Canada’s software sector.

Nuvei – Novacap (2024): Payment processor Nuvei’s partial privatization ~C$6.3B (Novacap rolled into a new vehicle) (dwpv.com), one of Canada’s largest-ever PE deals, shows Quebec funds leading in fintech.

eStruxture – Fengate (2024): Data-center firm acquired for C$1.8B (dwpv.com), underscoring PE appetite for infrastructure.

Sleep Country – Fairfax (2024): Mattress retailer sold for C$1.7B (dwpv.com) in a final-fifteen deal (packaged by former owners), highlighting PE exits in consumer retail.

Participant Profile: On the investor side, a 70/30 split of domestic vs foreign was common in 2024, according to CVCA.

Canadian pension/sovereign funds (OTPP, CPPIB) also subscribe to many PE funds but rarely appear as direct acquirers.

Notably, BDC Capital – the federal business development bank – launched a nearly C$1B late-stage tech fund in 2025 (betakit.com), and other government entities (EDC, Export Development; IP-Backed Finance, etc.) are active co-investors.

🧭 Private Equity Strategy Playbook

For Founders & CEOs: Make your business “PE-ready.”

Improve governance (add experienced directors, formal reporting) and build a strong CFO/operations team.

Highlight scalable revenue models and defendable market positions (e.g. IP, network effects) since PE buyers favor value drivers.

Consider PE as an exit or growth option: even if you’re not selling now, cultivating relationships with PE can open strategic partnerships or later buyouts.

Remember that partial exits (minority deals) are common – e.g. Fondaction, BDC often invest minority stakes in growth-stage companies (fasken.com).

Use PE interest to improve leverage (e.g. management incentive plans). And be patient: exits usually mean M&A or a controlled IPO, so time to exit may be 3–7 years post-investment.

For PE Investors: Focus on sectors and partners.

Tech/ICT and cleantech currently yield the biggest pools of targets.

Network with domestic LPs (pensions, government funds) to co-invest on large deals – many big 2024 transactions had multiple sponsors.

Keep an eye on regulatory trends: mandatory filings under the Investment Canada Act and aggressive merger reviews (Consumer + Investment Acts) mean more antitrust risk for larger deals (central.cvca.ca).

Build value-add beyond capital: operational expertise and ESG/DEI capabilities are selling points for portfolio companies.

Also, leverage Canada’s “stable economy” branding to compete for deals against US and Asian funds.

And because most deals are <C$25M, partnering with credit lenders or forming deal syndicates can help you scale deal flow.

For Policymakers & Ecosystem Builders: Ensure Canada remains attractive for PE capital.

Streamline review processes for strategic but benign foreign investments, and promote alignment between immigration, innovation and capital policies. Support frameworks that help mid-market firms scale (e.g. Canada Growth Fund, tax incentives, or export credit).

The federal government’s recent steps – like earmarking CI$ to match private growth equity or extending R&D credits – are positive signals.

Maintain dialogue with the PE community (via CVCA and others) so that policies (e.g. competition law changes) don’t inadvertently curb investment. And support secondary markets and later-stage financing (BDC’s new funds (betakit.com) are one model) so that fast-growing firms have domestic funding options before turning to US buyers.

🇨🇦 Canadian Angle

Canada’s PE ecosystem has unique flavors: government-backed funds play a big role.

BDC Capital is the country’s largest tech investor, recently putting almost C$1B into late-stage funds (betakit.com) to fill funding gaps. Québec’s fonds (Fonds de solidarité FTQ, Fondaction Québec) and CDPQ are super-angel investors: they participated in many deals (combined ~C$20B invested in H1/2025 alone. - cvca.ca).

At the provincial level, Investissement Québec co-invests in local champions (finance, cleantech, etc.). Canada has no direct “private equity tax credit” program (unlike some jurisdictions), but it offers R&D credits, IRAP grants, and the upcoming Clean Technology Investment tax credit, all of which make Canadian companies more attractive to PE.

Notably, in 2024 Canada launched the Canada Growth Fund (C$15B) to back climate and strategic tech sectors; some of its first deals (not yet public) are expected to be co-investments with PE funds.

In short, Canadian PE often involves a public-private partnership dynamic: LPs such as pension funds & sovereigns (CPPIB, OTPP, etc.) may back the funds, and government agencies frequently co-invest or guarantee debt (e.g. EDC co-financing export-related M&A).

For example, major PE deals in energy or infrastructure often involve export-credit or EDC support. Founders should leverage local supports (BDC loans/equity, regional development agencies) to make their deals more bankable.

🏁 Bottom Line

Canadian PE has rebounded sharply: 2024 and 2025 set new records in dollars raised, far exceeding the slow 2023 (intelligence.cvca.cacvca.ca).

Tech and cleantech lead: ICT deals consume the most capital (36% of 2023 dollars (fasken.com); $15.3B in 2024 (intelligence.cvca.ca), with energy transition investments on the rise.

Deals are mostly mid-market, but a few mega-deals (>$1B) drive totals (fasken.com, intelligence.cvca.ca). Expect many transactions <C$25M, especially early-stage financings.

Major players are hybrid: domestic champions (Onex, pension and union funds, BDC) co-exist with big U.S. sponsors. US firms like Thoma Bravo have taken large Canadian targets (betakit.com).

Exits remain M&A-focused: IPOs are rare. Strategy should assume long hold periods and exits via corporate sales or secondary funds (intelligence.cvca.ca,fasken.com).

In summary: Founders and investors should capitalize on Canada’s current momentum (cheap debt, strong dollars) to negotiate favourable deals, while policymakers should keep adapting regulation to sustain this growth.

In Canada’s PE market of 2024–25, growth is fueled by smart capital, and the bottom line is: be proactive, sector-savvy, and collaborate with local financial ecosystems to succeed.

If you like this research, check out our other free research reports on the Canadian Financing ecosystem.

Risk Disclaimer and Intended Use: This guide is intended to act as an educational resource, - not a definitive recommendation. Please reference underlying sources directly for further details. This guide is not a recommendation to raise capital from investors, US-based or otherwise. If you need advice for your business, you are welcome to contact us for a referral.