October 2025 Mid‑Market Canadian Financings, Transactions and Spin‑Offs Report

What Drove Canada’s Mid-Market Deals in October 2025: Top Financings, Mergers, and Spin-Offs Explained

Introduction: October 2025 Deal Flow Summary

October 2025 was an active month for Canada’s mid‑market transactions. In addition to headline‑grabbing megadeals, a large number of venture‑capital financings, strategic acquisitions and one notable spin‑off took place in sectors ranging from ag‑technology and telehealth to mining and logistics.

The research below draws on official press releases, company announcements and professional‑services summaries. All events occurred in October 2025 (dates are given in the Toronto time zone).

The term “mid‑market” is used broadly to include venture financings and acquisitions that did not exceed several billions of dollars.

Canadian Financing and Growth Investments - Oct 2025

Ag‑technology and Food

Vive Crop Protection

On 7 Oct 2025, Toronto‑based agricultural technology company Vive Crop Protection closed an oversubscribed US$10 million investment round led by Emmertech with participation from iSelect Fund, BDC Capital and a new investment from Farm Credit Canada (FCC )vivecrop.com.

The company explained the capital would accelerate its product pipeline and market expansion and that FCC’s participation aligned with its mandate to support agri‑food innovation (vivecrop.com).

Clearstone Capital → Brüst Beverages

On 30 Oct 2025, private‑equity firm Clearstone Capital acquired Brüst Beverages, a Toronto‑based producer of ready‑to‑drink protein coffee.

Clearstone plans to scale Brüst’s North‑American distribution and leverage its operational expertise (newswire.ca).

The transaction shows continuing interest in functional beverages and consumer health brands (newswire.ca).

Fintech and Financial Infrastructure

Wealthsimple financing round

Power Corporation of Canada and its subsidiary IGM Financial subscribed for Class E preferred shares in Wealthsimple on 27 Oct 2025. Each company invested $100 million as part of a financing round for up to $750 million, co‑led by GIC and Dragoneer (powercorporation.com).

Despite the new investment, the transaction left Power’s ownership in Wealthsimple largely unchanged (powercorporation.com).

Cybrid Series A

Stable‑coin payments infrastructure provider Cybrid announced on 22 Oct 2025 that it had raised US$10 million in a Series A round led by BDC Capital’s Growth Venture Fund, with Golden Ventures, Luge Capital and Panache Ventures participating (businesswire.com).

Cybrid plans to use the financing to accelerate adoption of its stable‑coin payment infrastructure among financial institutions and remittance providers (businesswire.com).

Nelnet Canada → Finastra’s student‑loan servicing business

U.S. education finance company Nelnet announced on 23 Oct 2025 that its subsidiary Nelnet Canada had agreed to acquire Finastra’s Canadian student‑loan servicing business, which serves approximately 2.4 million borrowers (prnewswire.com).

Financial terms were not disclosed, but RBC Capital Markets advised Finastra and the deal is expected to close in early 2026 (prnewswire.com).

Telehealth and Health Services

Felix Health growth financing

On 23 Oct 2025, telehealth provider Felix Health closed a C$53 million growth financing round led by the Canadian Business Growth Fund with participation from Whitecap Venture Partners, BMO Capital Partners, BDC’s Women in Tech Venture Fund, Scotiabank and H Venture Partners (fasken.com).

The financing will support expansion of its on‑demand virtual care services across Canada (fasken.com).

Sustainable Building and Decarbonisation

Cascadia Windows & Doors

On 1 Oct 2025, the Canada Growth Fund (CGF) committed C$30 million to a growth investment in Cascadia Windows & Doors, a British Columbia company making energy‑efficient fiberglass windows and doors (cgf-fcc.ca). MKB Equity Partners led the investment alongside Blue Earth Capital; the funds will support manufacturing expansion and decarbonisation in the building sector (cgf-fcc.ca).

Infrastructure and Government‑Led Investments - Oct 2025

The Canadian federal and provincial governments used innovative financing structures to catalyse large infrastructure projects.

Darlington New Nuclear Project (Small Modular Reactors)

On 23 Oct 2025, the Canada Growth Fund (CGF) and the Building Ontario Fund (BOF) announced a combined equity commitment of up to $3 billion(CGF up to $2 billion, BOF up to $1 billion) to finance Ontario Power Generation’s Darlington New Nuclear Project (cgf-fcc.ca).

The investment, structured as minority stakes with two capital tranches, aims to de‑risk the project and attract private and Indigenous investment (cgf-fcc.ca).

Rio Tinto scandium facility

On 31 Oct 2025, CGF and Rio Tinto agreed to an equity‑like financial royalty worth approximately C$25 million to expand a scandium oxide facility in Sorel‑Tracy, Quebec (cgf-fcc.ca). The transaction will help Canada secure supplies of the critical mineral scandium, which is used to strengthen aluminium alloys (cgf-fcc.ca).

Canadian Mergers and Acquisitions (M&A) - Oct 2025

Logistics and Supply Chain

GoBolt → Stalco

Sustainable logistics technology firm GoBolt announced on 30 Oct 2025 that it acquired Stalco, a Toronto‑based third‑party logistics company, to expand its Canadian fulfilment and last‑mile operations. GoBolt highlighted network expansion and carbon‑neutral delivery as benefits for Stalco’s merchants, and stated that the combined entity would offer merchants access to GoBolt’s U.S. network and integrated technology platform (gobolt.com).

Reesink Canada Holdings → Ag Authority

On 7 Oct 2025, Reesink Canada Holdings (part of Dutch equipment distributor Royal Reesink) acquired Ag Authority, an agricultural equipment dealer in Saskatchewan. The deal expands Reesink’s dealer network and strengthens its presence in large‑scale agricultural markets. Royal Reesink called the acquisition a continuation of its buy‑and‑build strategy (triton-partners.com).

Infrastructure & Energy Services

Northleaf Capital Partners → PowerStream Energy Services

On 7 Oct 2025, Northleaf Capital Partners announced that its infrastructure funds, through portfolio company Provident Energy Management, had acquired PowerStream Energy Services, a sub‑metering and billing solutions provider, from Alectra Energy Services. Northleaf said the acquisition complements its existing infrastructure portfolio and will allow PowerStream to pursue new growth opportunities (northleafcapital.com).

Sunoco LP → Parkland Corporation

U.S. fuel distributor Sunoco LP completed its acquisition of Parkland Corporation on 31 Oct 2025. Parkland shareholders received a combination of cash (approximately C$3.458 billion) and 51.5 million Sunoco Corp units, and Parkland shares were scheduled to be delisted from the Toronto Stock Exchange (parkland.caparkland.ca).

Consumer Products and Food

Maple Leaf Foods spin‑off

Maple Leaf Foods completed the spin‑off of its pork operations into a new publicly traded company, Canada Packers Inc., on 1 Oct 2025. Maple Leaf shareholders received 0.2 shares of Canada Packers for each Maple Leaf share, with Maple Leaf retaining a 16% stake (prnewswire.com). Canada Packers common shares began trading on the TSX as “CPKR” on 2 Oct 2025 (prnewswire.com). After the spin‑off, Maple Leaf focused on prepared foods and poultry, while Canada Packers operated pork production facilities with capacity to process nearly five million pigs per year (realagriculture.com).

Financial Services

iA Financial Corporation → RF Capital Group

Quebec‑based insurance and wealth‑management group iA Financial Corporation (TSX: IAG) completed the acquisition of RF Capital Group (TSX: RCG) on 31 Oct 2025. Under the court‑approved plan of arrangement, a wholly owned iA subsidiary purchased all RF Capital common shares for C$20.00 per share and all Series B preferred shares for C$25.00 per share plus accrued dividends (ia.ca). RF Capital’s shares are expected to be delisted, and iA said the acquisition adds roughly $43.6 billion of assets under administration and over 500,000 client accounts to its wealth division (ia.ca).

First National Financial Corp. → Birch Hill Equity Partners & Brookfield Asset Management

Mortgage lender First National announced on 22 Oct 2025 that a newly formed acquisition vehicle controlled by Birch Hill Equity Partners and Brookfield Asset Management acquired all outstanding First National shares (other than those held by founders) for C$48 per share, valuing the company at about C$2.2 billion (firstnational.ca). Founders Stephen Smith and Moray Tawse retained ~19% stakes. In connection with the arrangement, First National launched an $800 million senior‑notes offering, with proceeds to repay existing debt (firstnational.ca). The notes were structured in three tranches maturing in 2027, 2030 and 2035 with coupon rates from 6.4 % to 7.02% (firstnational.ca).

Boyd Group Services → Joe Hudson’s Collision Center (JHCC)

Auto‑repair consolidator Boyd Group Services agreed on 29 Oct 2025 to acquire Joe Hudson’s Collision Center, a U.S. operator with 160 shops. The purchase price is US$1.3 billion; Boyd expects to fund the acquisition through a mix of debt, equity and new senior notes (boydgroup.com).

Concurrently, Boyd launched a US$780 million bought‑deal offering of common shares and announced a C$525 million senior unsecured note offering to finance the deal (boydgroup.comboydgroup.com).

QCx Gold mining claims

Junior exploration company QCx Gold signed an agreement on 14 Oct 2025 to acquire a block of mining claims in Ontario for 6 million shares at C$0.28 each and C$15,000 in cash (investingnews.com). The vendor retained a 3% net smelter royalty, with QCx holding an option to buy back half the royalty for C$1 million (investingnews.com).

Mining and Precious Metals

McEwen Inc. → Canadian Gold Corp.

On 14 Oct 2025, McEwen Inc. agreed to acquire all outstanding shares of Canadian Gold Corp. via a statutory plan of arrangement. Each Canadian Gold share will be exchanged for 0.0225 McEwen common shares, implying a value of C$0.60 per share and representing a 96.7 % premium to the closing price prior to announcement (mcewenmining.com).

Upon completion, McEwen shareholders will own roughly 92 % of the combined company with Canadian Gold shareholders owning about 8 %; the transaction was expected to close in early 2026 (mcewenmining.com).

IAMGOLD → Northern Superior Resources

On 20 Oct 2025, IAMGOLD announced a definitive agreement to acquire Northern Superior Resources. Northern Superior shareholders will receive 0.0991 IAMGOLD shares plus C$0.19 in cash per share, implying C$2.05 per Northern Superior share and an overall transaction value of approximately $267.4 million (iamgold.com).

The deal consolidates the companies’ Quebec projects into a “Nelligan Mining Complex” and offers Northern Superior shareholders a 52 % premium (iamgold.com).

Fresnillo plc → Probe Gold Inc.

British mining company Fresnillo plc announced on 31 Oct 2025 that it would acquire Canadian explorer Probe Gold for C$3.65 per share, valuing the transaction at about C$780 million (fresnilloplc.com). The offer represents a 24 % premium to Probe’s 30‑day volume‑weighted average price. Fresnillo highlighted the acquisition as a strategic entry into Canada’s Val d’Or mining district and noted that the Novador project could produce over 200 000 ounces of gold per year for more than a decade (fresnilloplc.com).

Cenovus Energy → MEG Energy shares

Calgary‑based Cenovus Energy announced on 14 Oct 2025 that it had acquired 21 723 540 shares of MEG Energy, representing about 8.5 % of MEG’s outstanding shares (cenovus.com).

Cenovus said the purchases were made through market transactions between 8 Oct and 14 Oct and would be voted in favour of its previously announced transaction with MEG (cenovus.com).

Capital Market Transactions

While not acquisitions themselves, several deals in October 2025 involved the raising of large amounts of capital to fund or complete transactions:

First National senior‑notes offering

As mentioned earlier, and as part of its plan of arrangement, First National Financial launched an $800 million senior‑notes offering across three tranches (due 2027, 2030 and 2035) with coupon rates of 6.4 %, 6.9 % and 7.02 %, respectively. The proceeds will be used to redeem existing notes and reduce indebtedness (firstnational.ca).

Boyd Group equity and debt financings

To finance its acquisition of Joe Hudson’s Collision Center, Boyd Group Services announced a US$780 million bought‑deal public offering of common shares and a C$525 million senior unsecured note offering (boydgroup.comboydgroup.co.)

Oct 2025 Deal Trends and Key Takeaways

Sector diversity and cross‑border activity:

October 2025 saw deals across agriculture, logistics, energy, mining, finance and technology.

Cross‑border transactions were prominent: Fresnillo’s entry into the Canadian gold sector, Sunoco’s acquisition of Parkland and Nelnet’s purchase of Finastra’s Canadian loan‑servicing business illustrate ongoing foreign interest in Canadian assets.

Government‑backed capital and climate‑aligned investments:

The Canada Growth Fund took centre stage, committing billions to the Darlington small‑modular reactor project and investing in critical‑mineral production. These deals highlight policy‑driven efforts to de‑risk large infrastructure projects and accelerate decarbonisation.

Robust venture and growth financing:

Several technology‑oriented companies—Vive Crop Protection, Wealthsimple, Cybrid and Felix Health—closed mid‑sized funding rounds.

Investors included government funds (BDC, FCC), established family offices (Power Corporation) and specialist venture capitalists, demonstrating strong appetite for Canadian innovation.

Continued consolidation in financial services and wealth management:

iA Financial’s acquisition of RF Capital follows other wealth‑platform deals as firms seek scale to support advisor technology and product breadth.

Similarly, First National’s sale to Birch Hill and Brookfield and Nelnet’s entry into the Canadian student‑loan servicing market underscore private‑equity and strategic interest in financial services.

Mining resurgence:

Three notable mining transactions—Fresnillo/Probe, IAMGOLD/Northern Superior and McEwen/Canadian Gold—reflect rising gold prices and consolidation in junior miners.

These deals often involve stock or cash‑and‑stock consideration and large premiums, signalling competitive bidding for exploration projects.

Spin‑off as a strategic tool:

Maple Leaf Foods’ spin‑off of Canada Packers allowed investors to separate the cyclical pork business from Maple Leaf’s higher‑margin prepared foods division. Such restructurings may provide clarity for investors and unlock value.

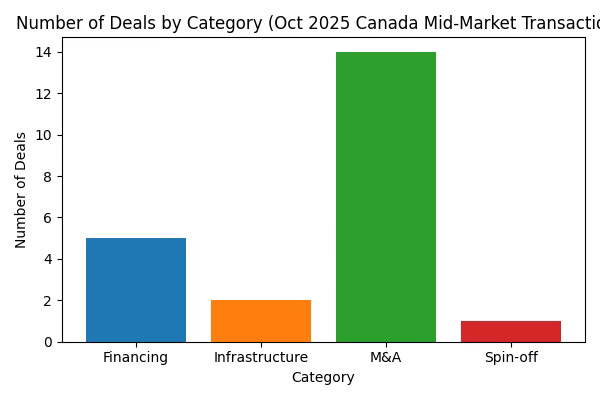

Visual Summary

The chart below counts the number of transactions in each category (financings, infrastructure, M&A and spin‑offs) to illustrate the breadth of activity in October 2025.

Conclusion

October 2025 demonstrated the resilience and dynamism of Canada’s mid‑market deal environment. Despite uncertain economic conditions, companies across multiple sectors secured growth financing, executed strategic mergers and spin‑offs, and raised capital to fund ambitious acquisitions.

Government funds played an outsized role, particularly in energy and critical minerals, while private‑equity and foreign strategics continued to view Canadian assets as attractive.

Looking ahead, the confluence of technology adoption, sustainability imperatives and cross‑border capital suggests that mid‑market activity will remain a vital component of Canada’s corporate landscape.

Risk Disclaimer and Intended Use: This report is intended to act as an educational resource, - not a definitive recommendation. Please reference underlying sources directly for further details. This report is not a recommendation to raise capital from investors, US-based or otherwise. If you need advice for your business, you are welcome to contact us for a referral.

Thanks for reading! Subscribe for free to receive new posts to help you grow your business faster and more easily.