How to Structure a Friends & Family Round the Right Way in Canada

A comprehensive guide to raising your first startup capital from friends and family in Canada. Learn about legal exemptions, tax credits, valuation methods, and provincial incentives.

Executive Summary

A friends and family round is often the first outside capital a Canadian startup raises. When done well, it can accelerate development without jeopardizing relationships or future fundraising.

This guide provides a comprehensive overview of how to structure these rounds in Canada, covering legal compliance, tax and valuation considerations, deal documentation, and the role of provincial incentives.

Data from the Canadian Venture Capital & Private Equity Association (CVCA) and recent case studies show that pre-seed and seed investment activity remains robust but is evolving, with average deal sizes fluctuating and investors favouring sectors like AI and SaaS (central.cvca.ca, ncfacanada.org).

The guide also highlights the role of SAFEs, convertible notes, and other instruments, and explains how founders and investors can navigate exemptions under Canadian securities laws and provincial tax credit programs. Keep reading to learn more, and subscribe to stay updated on everyday deal news!

Context & Why It Matters

Startup funding in Canada has shifted dramatically over the past few years. CVCA data show that seed investments hit a record $1.1 billion in 2023 but declined sharply in H1 2024, with $292 million raised from 148 deals, a 48 % drop in value and 31 % drop in deal count from the previous year (central.cvca.ca).

Average seed deal sizes fell from $2.88 million in 2023 to $1.97 million in 2024, while pre‑seed deals averaged $0.9 million (central.cvca.ca, central.cvca.ca). By H1 2025, seed cheques stabilized around $3 million, with Ontario and AI‑focused startups leading deal flow (ncfacanada.org).

Simultaneously, generational wealth gaps make friends‑and‑family rounds inaccessible for many founders; organizations like the DMZ have launched programs to address this inequity (dmz.torontomu.ca). Understanding how to structure a friends‑and‑family round responsibly is therefore both timely and crucial.

Key Insights

✅ Typical size and equity – Friends & family rounds usually raise $50k–$500k and investors receive 10–15 %of the company (rho.cojoinarc.com). Seed rounds, by contrast, average $1–3 million, and pre‑seed rounds often raise less than $1 million (central.cvca.ca).

🧠 Documentation matters – Documenting the deal protects relationships.

Instrument choice (loan, equity, convertible note, SAFE, or gift) determines rights, tax treatment and future dilution (trustiics.comrho.co).

A clear written agreement, a well‑maintained cap table and legal counsel are essential dbhllp.com).

⚠️ Legal exemptions are narrow – Any sale of securities in Canada must comply with provincial securities laws. Exemptions include the Private Issuer and Family/Friends Business Associates exemptions, which limit the number and type of investors; the Accredited Investor exemption; and the Offering Memorandum (dbhllp.com, dbhllp.com). Abuse of these exemptions can attract regulatory scrutiny (mcmillan.ca).

💰 Convertible notes vs SAFEs –

Convertible notes are debt instruments with interest (typically 2–8 %) and maturity periods 18–24 months; they convert to equity at a discount and may trigger tax events (parrbusinesslaw.com).

SAFEs convert to equity without maturity or interest and are popular at pre‑seed; their classification for tax purposes (debt vs equity) affects whether investors realise income on conversion multanitax.ca, multanitax.ca).

🧩 Valuation is dynamic – Pre‑seed valuations are often determined by what investors will pay rather than revenue.

🇨🇦 Provincial incentives – Tax credit programs reduce risk for early investors.

British Columbia’s Eligible Business Corporation (EBC) program offers a 30 % tax credit on equity investments for qualifying BC‑based companies (fhplawyers.com, fhplawyers.com), and SAFEs count toward the initial capital requirement (fhplawyers.com).

Saskatchewan’s Technology Start‑Up Incentive (STSI) provides a 45 % non‑refundable tax credit with investment caps and a three‑year hold period (hellodarwin.com).

Manitoba is modernizing its program to lower the minimum investment and allow SAFEs (mltaikins.com).

📊 Capital gains & tax changes – Canada’s 2024 budget raised the capital‑gains inclusion rate from 50 % to 66.7 % for individuals over $250k and corporations (cbvinstitute.com). A new Canadian Entrepreneurs’ Incentive reduces the inclusion rate to 33.3 % on a lifetime maximum of $2 million for eligible business owners (canada.ca). These changes influence how founders and investors structure early‑stage deals.

How It Works: Structuring a Friends & Family Round

Assess readiness and funding needs. Confirm that you have a viable idea, early traction or prototypes, and that personal funds are exhausted. Determine how much capital is required to reach the next milestone and estimate a reasonable pre‑money valuation using methods like the Berkus or scorecard models (zeni.ai).

Select the right instrument.

Loan: A promissory note with interest and a repayment schedule offers flexibility but creates debt; you must set a fair interest rate and document terms (rho.co).

Equity: Sell common or preferred shares; typical F&F deals involve giving up 10–15 % of equity (rho.co). Ensure you remain below the 50‑shareholder limit if using the Private Issuer exemption (dbhllp.com).

Convertible note: A debt instrument that converts to equity when a trigger (usually the next priced round) occurs; include a valuation cap and discount rate to reward early investors (parrbusinesslaw.com). Interest accrues and is taxable before conversion (parrbusinesslaw.com).

SAFE: A Simple Agreement for Future Equity converts investment to shares at a discount or valuation cap without interest or maturity. SAFEs are widely used in pre‑seed and may qualify for provincial tax credits if structured properly (multanitax.ca).

Gift: Friends and family may provide funds as a non‑repayable gift. While rare, gifts avoid dilution but can create tax complexities and relationship risks.

Comply with securities laws. Identify the exemption that applies (Private Issuer, Family/Friends Business Associates, Accredited Investor or Offering Memorandum). The Family/Friends exemption requires a genuine close relationship; misuse can attract regulatory scrutiny (mcmillan.ca).

Prepare written agreements and disclosures. Draft a term sheet or investment agreement that includes the amount, type of instrument, conversion terms, valuation cap or discount, and investor rights. Provide transparent information about the company, avoid making unrealistic promises, and outline risks (dbhllp.com). Maintain a cap table and ensure share transfers are restricted when using the Private Issuer exemption (dbhllp.com).

Set a fair valuation and cap. Work backward from the amount you are raising and the equity you are willing to give up. For convertible instruments, negotiate a valuation cap (e.g., $3–6 million) and a discount (often 10–30 %) (parrbusinesslaw.com).

Manage investor relations. Treat friends and family as investors: provide regular updates, formalise communications, and clarify expectations about exit timing. Avoid adding too many investors; a small, aligned group simplifies governance and future rounds.

Plan for future rounds. Keep documentation and financials clean to attract angel or VC investors later. Understand that early‑stage instruments like SAFEs and convertible notes will convert at the next priced round, affecting dilution and cap table composition.

Data, Trends & Case Studies

Investment Trends

Declining seed activity – Seed investments in Canada peaked in 2023 with $1.1 billion across 383 deals, but H1 2024 saw a 48 % decline in value (central.cvca.ca). Average seed deal sizes fell 31 %, dropping from $2.88 million to $1.97 million (central.cvca.ca).

Pre‑seed distribution – Nearly half (49 %) of pre‑seed deals in H1 2024 were below $0.5 million, 23 % ranged between $0.5 M and $1 M, and 26 % fell between $1 M and $3 M (central.cvca.ca). Average pre‑seed deal size was $0.9 million (central.cvca.ca).

Sector focus – Information and communications technology (ICT) companies attracted 57 % of seed dollars and 43 % of deals in H1 2024 (central.cvca.ca). AI and SaaS remain top verticals; in H1 2025 AI startups raised $24 M across 12 deals, while SaaS raised $12 M across 4 deals (ncfacanada.org).

Provincial dynamics – Ontario dominated seed activity in H1 2025 with $115.1 M across 36 deals, followed by Quebec with $66.1 M across 18 deals (ncfacanada.org). Alberta ($32.4 M) and BC ($28.5 M) provided smaller but steady pipelines (ncfacanada.org).

Foreign participation – U.S. investors joined 27.9 % of Canadian seed deals in H1 2025, down from 35.9 % in 2023 (ncfacanada.org). International investors accounted for about 10 %, signalling a shift toward domestic-led rounds.

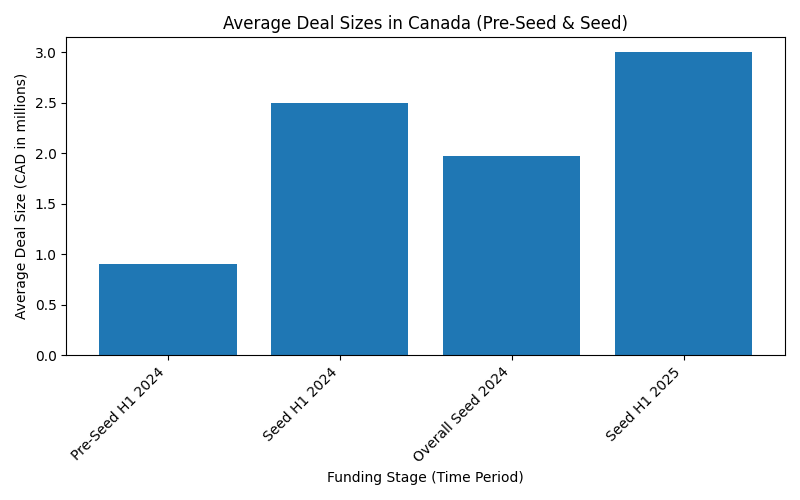

Chart: Average Pre‑Seed and Seed Deal Sizes

Below is a bar chart summarising average deal sizes for different stages and time periods. It shows how pre‑seed deals average around $0.9 M, seed deals $2.5–3.0 M, and that 2024’s average seed deal size dipped during a period of market adjustment before rebounding in 2025.

🧩 Case Studies

In Vancouver, ShopVision (2024–2025) offers a textbook example of how to use a friends-and-family round strategically. Before raising its $5.6 million CAD seed round, the company—founded by one of Elastic Path’s co-founders—relied on a mix of founder capital, friends-and-family contributions, and Canadian research grants (betakit.com). That early capital allowed the team to build an AI-powered market-research product, secure real customer traction, and present a clean financial picture to institutional investors. The lesson? Align early investors around the mission and use non-dilutive grants to stretch your initial round. Make sure finances are clearly organised so later investors can easily understand what converts and when.

In Toronto, Una Software followed a similar path. The company began with capital from its founders, friends and family, and early angels through Simple Agreements for Future Equity (SAFEs) (betakit.com). This structure gave Una the flexibility to raise without setting a valuation too early, while signalling to future investors that the team understood how to manage convertible instruments. That early foundation helped Una later close a $13.9 million CAD seed round led by Staircase Ventures. The takeaway here is that SAFEs can be a founder-friendly tool for early backers—simple to execute, tax-efficient, and attractive to later-stage investors.

Meanwhile, the DMZ Angel Program at Toronto Metropolitan University highlights a different but equally important angle: access. Recognizing that many founders lack the personal or family wealth to start with a friends-and-family round, the DMZ launched a program to democratize early-stage capital and support underrepresented entrepreneurs (dmz.torontomu.ca). The initiative underscores a growing policy concern in Canada—that access to startup capital too often depends on who you know or how wealthy your network is. The broader lesson is that policymakers and incubators must continue building inclusive funding bridges, so that talent, not privilege, determines who gets to scale.

Canadian Angle: Legal, Tax & Incentive Landscape

Securities Law Exemptions

Founders raising capital from friends and family must comply with provincial securities regulations. Under National Instrument 45‑106, key exemptions include:

Private Issuer exemption

Company must be a private issuer (not a reporting issuer), restrict share transfers, and have ≤50 shareholders excluding employees. Only directors, officers, employees, founders, close family members or accredited investors may participate (dbhllp.com).

Family, Friends & Business Associates

Allows sales to specified relatives (spouse, parent, grandparent, child, sibling) and close friends with a genuine personal relationship. Evidence of relationship may be required; abuse can lead to regulatory action (dbhllp.com, mcmillan.ca).

Accredited Investor

Investors with high income or net worth may invest without limits. Founders can raise larger amounts but must verify accredited status (dbhllp.com).

Offering Memorandum

Requires a formal disclosure document and financial statements but allows broader marketing. Some provinces (e.g., Alberta) use this when other exemptions don’t apply (dbhllp.com).

Convertible Instruments & Tax Treatment

Convertible notes: Debt that converts to equity; interest (often 2–8 %) accrues and is taxable to the investor before conversion. Terms typically include a valuation cap and discount rate (10–30 %) (parrbusinesslaw.com, parrbusinesslaw.com).

SAFEs: An equity-like contract; no maturity or interest. For tax purposes, SAFEs may be treated as equity, debt or a hybrid. Classification affects when investors report income or capital gains and whether interest is deductible (multanitax.ca). Provinces like BC and Saskatchewan require SAFEs to have a minimum term (e.g., five years) and no preferential rights to qualify for tax credits (multanitax.ca, multanitax.ca).

💰 Provincial Tax Incentive Programs

Canada’s patchwork of provincial tax-credit programs can quietly supercharge early funding rounds — if founders know how to use them. These incentives not only reward early investors but also help startups extend limited capital, attract local backers, and validate their growth plans before institutional money arrives.

Across Canada, several provinces have introduced tax-credit programs designed to encourage private investment in early-stage companies—often providing a helpful multiplier effect for friends-and-family capital. These programs can dramatically improve investor appetite and founder runway when structured correctly.

In British Columbia, the Eligible Business Corporation (EBC) program is among the country’s most established. It offers investors a 30 % provincial tax credit on qualifying investments, with unused credits carried forward for up to four years and back one year (fhplawyers.com).

To qualify, a company must maintain a substantial BC presence—typically no more than 100 employees, with at least 75 % of its payroll and 80 % of its assets located in the province—and engage in activities like manufacturing, clean tech, digital media, or proprietary technology R&D. At least $25,000 in equitymust be raised before certification. Notably, SAFEs can count toward that capital threshold, but they themselves do not generate investor tax credits. The program’s design rewards early investors while keeping the focus on home-grown innovation.

Saskatchewan’s Technology Startup Incentive (STSI) offers one of the most generous provincial credits: a 45 % non-refundable tax credit on eligible investments up to $225,000 per investor, with a per-startup cap of $2 millionhellodarwin.com. Investors must hold their shares for at least three years. To qualify, startups need their head office and fewer than 50 employees in Saskatchewan and must operate in digital or clean-technology sectors. Companies that have raised less than $5 million in total equity can apply, and convertible instruments such as SAFEs must convert to shares and be held for the minimum holding period. This structure has made STSI a cornerstone of Saskatchewan’s tech-ecosystem growth.

In Manitoba, a recent modernisation of the Small Business Venture Capital Tax Credit aims to make early-stage investing more accessible. The 2025 update proposes expanding the program’s annual budget, reducing the minimum investment from $10,000 to $5,000, and explicitly allowing SAFEs and participation via limited partnershipsmltaikins.com. Historically, the program provided a 45 % credit for qualifying investments in Manitoba-based firms that met local employment and size criteria. By reducing barriers to entry, the province hopes to attract more grassroots capital into its innovation economy.

Elsewhere, Ontario, Quebec, and Alberta also offer innovation and R&D incentives such as the Ontario Innovation Tax Credit and the federal Scientific Research and Experimental Development (SR&ED) program. While these do not specifically target friends-and-family investments, they remain valuable complements—particularly for founders reinvesting early capital into eligible R&D spending. The key takeaway is that provincial and federal programs, when layered thoughtfully, can stretch a small early-stage round into meaningful growth capital.

Capital‑Gains & Exit Considerations

The capital gains inclusion rate increased from 50 % to 66.7 % for gains realised after June 25 2024 for individuals exceeding $250k, corporations and trusts (cbvinstitute.com).

The Canadian Entrepreneurs’ Incentive reduces the inclusion rate to 33.3 % on a lifetime maximum of $2 million of eligible gains for owners who own >50 % of the business and have been actively involved for 24 months (canada.ca). Combined with the enhanced lifetime capital‑gains exemption, entrepreneurs may realise up to $3.25 million tax‑free (canada.ca).

For investors, this means that early equity may benefit from preferential tax treatment if held long enough and if program conditions are met. For founders, it shapes exit strategy and influences whether to structure early investments as debt (convertible notes) or equity.

Bottom Line

Start small but be diligent. A friends‑and‑family round typically raises $50k–$500k and should offer clear terms, fair valuations and thorough documentation. Ensure compliance with securities law exemptions and maintain a clean cap table.

Leverage convertible instruments wisely. SAFEs and convertible notes enable quick fundraising without setting a fixed valuation. Choose the right instrument based on investor preferences, tax implications and provincial program eligibility (parrbusiness, law.commultanitax.ca).

Tap provincial incentives and plan for tax. Programs in BC, Saskatchewan and Manitoba offer 30–45 % tax credits and require specific conditions(fhplawyers.com, hellodarwin.com). Consider how the 2024 capital‑gains inclusion rate change and the Canadian Entrepreneurs’ Incentive affect long‑term returns (cbvinstitute.comcanada.ca).

Prepare for future rounds. Document everything, manage investor relations professionally, and structure deals so that later investors can easily convert early instruments. Use early capital to reach milestones that attract angels and VCs.

Promote equitable access. Recognize that not all founders have access to wealthy networks; support initiatives like the DMZ’s angel program and aim to diversify your investor base (dmz.torontomu.ca).

At the end of the day: Raising a friends-and-family round the right way isn’t just about securing early capital — it’s about building trust, structure, and momentum that set the tone for every round to come.

Founders who treat even the smallest investments with professionalism — clear terms, transparent communication, clean documentation, and strategic use of tax incentives — position themselves for long-term credibility.

In Canada’s evolving funding landscape, where community capital, government programs, and private investors are increasingly intertwined, those early commitments are more than money; they’re the foundation of a company’s future story.

Risk Disclaimer and Intended Use: This guide is intended to act as an educational resource, - not a definitive recommendation. Please reference underlying sources directly for further details. This guide is not a recommendation to raise capital from investors, US-based or otherwise. If you need advice for your business, you are welcome to contact us for a referral.