How to Raise Money from U.S. Investors as a Canadian Company

Smart, structured, and insanely useful. A founder’s playbook for structuring, tax, and messaging to win U.S. venture capital while keeping Canadian advantages.

🔍 Executive Summary

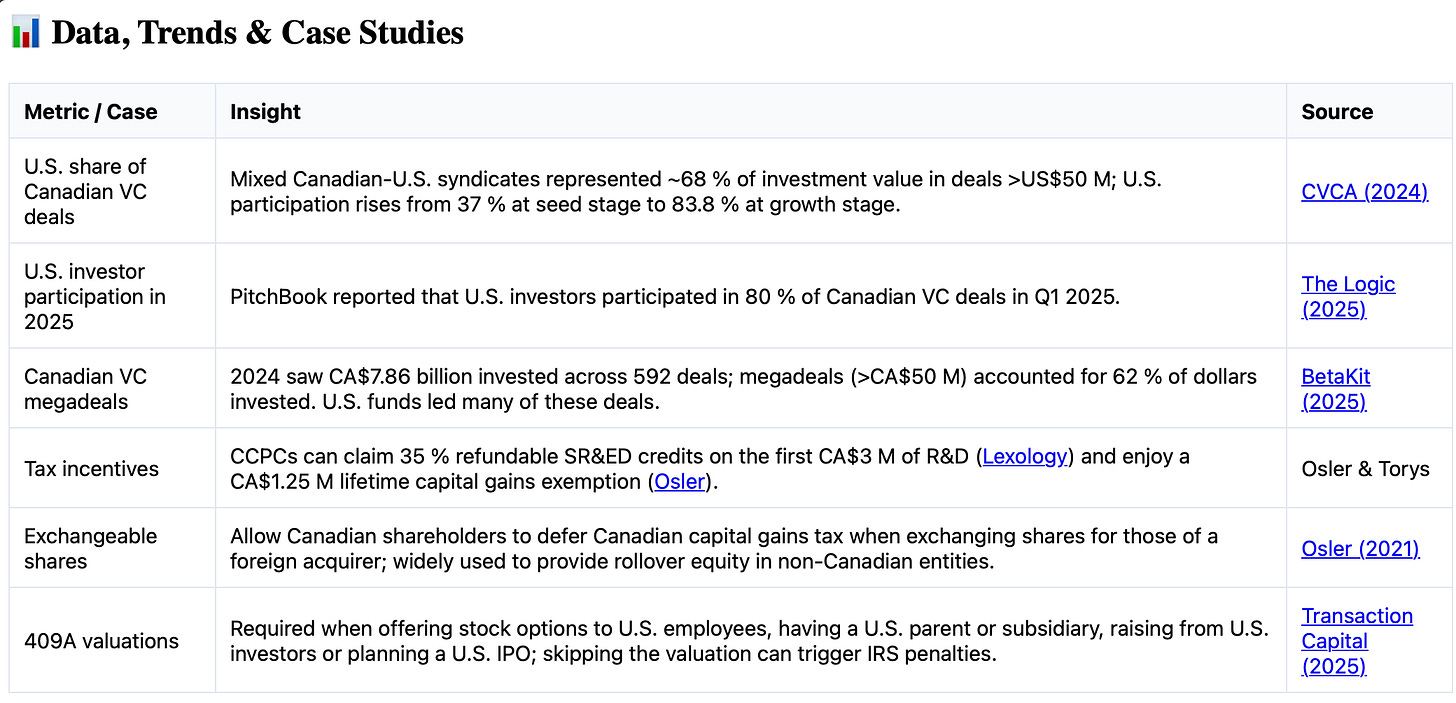

U.S. venture capital (VC) has become a lifeline for Canada’s innovation economy. In 2024–25, U.S. investors participated in roughly 80 % of Canadian VC deals and dominated investment rounds above CA$50 million (central.cvca.ca). Accessing this capital isn’t just about bigger cheques—it’s about tapping into networks, expertise and valuations that can catapult Canadian companies onto the global stage.

But raising south of the border adds layers of complexity around legal structure, tax, valuation and messaging. This guide distills the latest insights from legal experts, venture capital analysts and founders to help you navigate cross‑border fundraising.

You’ll learn why U.S. money matters, how to structure your company, what tax rules apply, and how to craft a pitch that resonates with U.S. investors—all while preserving the Canadian advantages you enjoy as a Canadian‑controlled private corporation (CCPC). At the end you’ll find actionable steps, case studies and a strategy playbook tailored for founders, investors and policymakers.

🧩 Context & Why It Matters

America’s outsized role in Canadian VC – U.S. investors supply the majority of capital at later stages.

Data from the Canadian Venture Capital & Private Equity Association (CVCA) shows that Canadian‑only syndicates account for about 70 % of deals under US$5 million, but mixed Canadian‑U.S. syndicates represent ~68 % of deals above US$50 million (central.cvca.ca).

Participation climbs from 37 % at seed stage to over 83 % at growth stage (central.cvca.ca).

Dependence on U.S. capital is accelerating – PitchBook estimates that U.S. investors participated in 80 % of Canadian VC deals in Q1 2025 (thelogic.co). Record megadeals such as Clio’s CA$1.24 billion Series F and Cohere’s US$616 million Series D were led by U.S. funds (betakit.com).

Policy and tax changes are raising the stakes – Proposed U.S. “Section 899” legislation would allow retaliatory withholding taxes of up to 50 % on dividends paid to residents of countries (including Canada) that impose digital services taxes (blg.com). While not yet enacted, such proposals underscore the need for careful structuring.

Canadian advantages remain real – Incorporating as a CCPC yields valuable tax benefits: enhanced Scientific Research & Experimental Development (SR&ED) credits of up to 35 % on the first CA$3 million of qualified expenditures and a lifetime capital gains exemption of CA$1.25 million for founders and employees (osler.com). Many U.S. investors are comfortable investing directly in CCPCs (osler.com).

💡 Key Insights

You don’t need a U.S. entity to raise from U.S. investors, but structure matters. Torys LLP notes that startups often incorporate both in Canada and the U.S., but investments are typically made at the parent company levellexology.com. Corporate law in Canada is similar to Delaware corporate law; U.S. investors frequently invest directly in Canadian entities. (lexology.com).

Early structuring decisions impact tax incentives. To qualify for enhanced SR&ED credits, your company must remain a Canadian‑controlled private corporation (CCPC) and not be controlled by non‑residentslexology.com. Flipping to a U.S. parent too early may cause founders to lose these credits and the lifetime capital gains exemption (lexology.com).

Delaware flips and exchangeable shares can satisfy U.S. investor requirements. A Delaware flip involves forming a U.S. parent and exchanging Canadian shares for U.S. shares. It simplifies access to U.S. capital markets but is costly and should be done early to keep the cap table simple (ssm.legal). Alternatively, exchangeable share structures allow Canadian shareholders to swap their Canadian shares for exchangeable shares that mirror U.S. shares while deferring Canadian capital gains taxes (osler.com).

U.S. investors care about IP location and due diligence. Reuters notes that investors focus on whether the entity they invest in holds the business assets (IP, customers, revenue) and encourage founders to develop a clear patent strategy to highlight competitive advantages (reuters.com). Holding IP in Canada is generally preferable for tax reasons (lexology.com).

409A valuations may be required. Section 409A of the U.S. Internal Revenue Code requires an independent fair‑market‑value appraisal when granting stock options to U.S. employees. Canadian startups need a 409A valuation if they have U.S. workers, subsidiaries or plan to raise capital from U.S. investors; many U.S. VCs insist on seeing a compliant report (txncapitalllc.com). Skipping it can lead to IRS penalties for employees and legal exposure for the company (txncapitalllc.com).

Currency and tax issues have been simplified but still matter. Cross‑border tax rules around PFIC, Subpart F and GILTI have been modernized, reducing obstacles for U.S. investorslexology.com. The Canada‑U.S. tax treaty reduces Canadian withholding tax on dividends to 15 % (5 % for substantial corporate shareholders) and eliminates most withholding on interest (dentons.com).

Professionalism wins. U.S. investors expect polished data rooms, investor updates and pitch decks. Tools that provide AI‑powered organization, engagement analytics and branded presentations can help Canadian founders match U.S. standards (peony.ink).

🛠 How It Works (Step‑by‑Step)

1. Decide Whether to Incorporate in Canada, the U.S., or Both

Stay Canadian for tax perks. Remaining a CCPC maximizes SR&ED credits and the lifetime capital gains exemption (osler.com). U.S. investors often invest directly in Canadian companies (osler.com).

Create a U.S. subsidiary or sister company. If you have significant U.S. operations or plan to hire U.S. employees, forming a U.S. subsidiary can reduce the need to file U.S. tax returns for the Canadian parent and allow income allocation between jurisdictions (reuters.com).

Consider a Delaware flip. A Delaware flip makes your Canadian company a wholly owned subsidiary of a Delaware corporation and may be required at the first priced U.S. round. Obtain shareholder and creditor consents, transfer IP, and complete the flip before your cap table becomes crowded (ssm.legal).

Use exchangeable shares to defer tax. An exchangeable share structure allows Canadian shareholders to exchange their Canadian shares for exchangeable shares in a Canadian subsidiary of the U.S. parent. The shares carry economic rights equivalent to U.S. shares and provide tax deferral (osler.com).

2. Preserve Tax Incentives and Manage Compliance

Maintain CCPC status until losing it makes sense. Monitor ownership to ensure non‑resident investors do not control the company. If U.S. investors require a majority stake, plan for a flip or exchangeable share structure.

Claim SR&ED credits. Eligible CCPCs receive refundable credits of up to 35 % on the first CA$3 million of R&D expenditures; provincial credits add morelexology.com. As your company grows, these credits may diminish—plan corporate structures that maximize eligibility (lexology.com).

Understand QSBS vs. Canadian exemption. U.S. investors only benefit from the Qualified Small Business Stock (QSBS) tax exemption if investing in a U.S. corporation; Canadian investors lose their own lifetime capital gains exemption if shares are issued by a U.S. entity (lexology.com). Balance these competing incentives.

Get a 409A valuation. Hire a qualified appraiser to produce an IRS‑compliant report if you have U.S. employees, a U.S. subsidiary, or plan to raise from U.S. investors. Situations requiring 409A include offering stock options to U.S. workers, having a U.S. parent/subsidiary, seeking U.S. VC funding, preparing for a U.S. IPO or acquisition, or conducting secondary share transactions (txncapitalllc.com).

3. Prepare Your Company and Pitch for U.S. Investors

Simplify your cap table and governance. Use one class of common shares and one class of preferred shares where possible. Ensure your shareholder agreements include drag‑along, tag‑along and voting rights needed by U.S. investors.

Protect and locate intellectual property. Register patents, trademarks and copyrights in jurisdictions where you operate. A clear patent strategy is a powerful narrative for U.S. investors and can protect your competitive edge (reuters.com). Consider keeping IP in Canada to avoid U.S. tax exposure (lexology.com).

Build a data room that meets U.S. standards. Provide financial statements, cap table, customer contracts, IP assignments, employment agreements and regulatory compliance documents. Tools like Peony or Carta can help organize and share materials professionally (peony.ink).

Price your round appropriately. Set share prices in U.S. dollars for investors south of the border or dual‑denominate to reduce currency risk (lexology.com). Understand valuation expectations—U.S. investors often value growth and market potential more highly but also expect higher traction.

Highlight Canadian advantages in your narrative. Emphasize Canada’s cost‑effective talent, access to SR&ED credits and a supportive regulatory environment. Use success stories (e.g., Shopify, 1Password, Wealthsimple, Cohere) to show that Canadian companies can scale globally with U.S. capital.

4. Connect and Raise

Leverage networks. Use existing investors, accelerators (e.g., Y Combinator, Techstars, CDL), and Canadian consulates to make introductions. Attend U.S. conferences such as TechCrunch Disrupt, SaaStr and industry‑specific events.

Target the right funds. Identify U.S. VCs that have invested in Canadian companies or your sector. Early‑stage U.S. funds may invest as small as US$2–5 million; growth funds typically look for CA$10–50 million+ rounds.

Run a disciplined process. Schedule meetings in a tight window, provide clear deadlines, and communicate progress. Use legal counsel experienced in cross‑border deals to review term sheets and ensure compliance with U.S. and Canadian securities laws.

Close and follow up. Once investors commit, move quickly to close by finalizing definitive agreements, board consents and regulatory filings. After closing, maintain investor relations with regular updates and governance practices.

Sources: CVCA, The Logic, BetaKit, Osler, Transaction Capital.

Case Studies & Examples

Shopify – Founded in Ottawa and incorporated in Canada, Shopify raised multiple rounds from U.S. investors (e.g., Bessemer Venture Partners, Tiger Global) without flipping until its U.S. IPO. The company maintained its Canadian headquarters and benefited from SR&ED credits while providing U.S. investors with growth returns.

1Password – The Toronto‑based password‑management company raised US$620 million in Series C funding in 2023 led by U.S. firms (ICONIQ, Tiger Global). It remains a Canadian entity but created a U.S. subsidiary for sales and staff.

Cohere – The AI startup raised a US$616 million Series D in 2024 led by investors including NVIDIA and Salesforce Ventures (betakit.com). Cohere’s cross‑border structure includes a Delaware entity to ease large U.S. investments while keeping R&D in Canada to benefit from SR&ED.

🧭 Strategy Playbook

For Founders

Start with why – Determine whether you need U.S. capital based on your market size and growth ambitions. If you aim for a global market or require deep pockets for R&D, U.S. VC may be necessary.

Optimize structure early – Decide on CCPC vs. flip vs. exchangeable shares before significant value is created to minimize tax consequenceslexology.com. Consult cross‑border tax specialists and corporate counsel.

Build relationships – Develop connections with U.S. investors before you need capital. Attend U.S. conferences, leverage alumni networks and incubators, and seek intros from existing investors.

Tell a big story – U.S. investors are drawn to large market opportunities and transformational technology. Emphasize your addressable market, unique IP and traction. Tie Canada’s advantages—world‑class talent, cost efficiency and supportive government programs—into your narrative.

Prepare for due diligence – Clean up your cap table, ensure IP assignments are in place, produce U.S. GAAP‑compatible financials and get a 409A valuation where required (txncapitalllc.com).

For Investors

Respect Canadian advantages – Recognize the value of SR&ED credits, lower operating costs and stable regulatory environment. Investing directly in Canadian entities can offer competitive valuations and access to top talent.

Be flexible on structure – Not every deal requires a flip; many high‑profile Canadian startups remain CCPCs. Use exchangeable share structures when a U.S. holding company is necessary but Canadian shareholders want tax deferral (osler.com).

Monitor policy risk – Stay abreast of changes such as potential U.S. Section 899 withholding taxes (blg.com) and updates to Canada’s tax incentives. Factor currency hedging into valuations.

For Policymakers

Expand domestic capital pools – Data shows foreign investors dominate large rounds (central.cvca.ca). Encourage institutional investors and pension funds to allocate more to Canadian VC to reduce dependence on U.S. capital.

Enhance SR&ED and VCCI programs – Maintaining and expanding refundable R&D credits and the Venture Capital Catalyst Initiative will help Canadian companies stay at home longer.

Strengthen cross‑border support – Through trade missions, consulate programs and investment hubs, help Canadian startups connect with U.S. investors and navigate regulatory hurdles.

🇨🇦 Canadian Angle

CCPC benefits – SR&ED tax credits (up to 35 %) and the lifetime capital gains exemption make remaining a Canadian‑controlled private corporation attractivelexology.com. These benefits vanish if non‑resident control is established.

Venture Capital Catalyst Initiative (VCCI) – The federal program has invested more than CA$1.76 billion into Canadian VC funds since 2017, catalyzing private investment (rbcx.com). This helps build domestic capital pools.

Global Skills Strategy – Canada’s immigration program expedites work permits for highly skilled foreign talent, giving startups an advantage in recruiting global expertise.

Exchanges & Public markets – Canadian companies can access U.S. public markets via cross‑listings (NYSE, NASDAQ) while retaining a Canadian domicile. The multi‑jurisdictional disclosure system (MJDS) streamlines cross‑border offerings.

🏁 Bottom Line

U.S. money is critical for scaling Canadian startups: U.S. investors participate in 80 % of deals and dominate large rounds (central.cvca.ca).

Maintain Canadian advantages while preparing for U.S. investors. Take full advantage of SR&ED credits and the lifetime capital gains exemption; only flip or use exchangeable shares when necessary (osler.com).

Structure thoughtfully. Choose between staying a CCPC, forming a U.S. subsidiary, executing a Delaware flip or using exchangeable shares based on your investor base and exit strategy (ssm.legal), (osler.com).

Plan for tax and compliance. Understand withholding tax, 409A requirements and potential legislative changes like Section 899 (blg.com).

Craft a compelling cross‑border pitch. Highlight big markets, unique technology and Canada’s cost‑effective ecosystem; maintain a professional data room and leverage networks to build relationships with U.S. investorspeony.ink.

By understanding the structures, incentives and cultural nuances of cross‑border investment, Canadian founders can confidently tap into America’s deep pools of capital while retaining the benefits of building in Canada.

Risk Disclaimer and Intended Use: This guide is intended to act as an educational resource, - not a definitive recommendation. Please reference underlying sources directly for further details. This guide is not a recommendation to raise capital from investors, US-based or otherwise. If you need advice for your business, you are welcome to contact us for a referral.

Spot on. You really nail the core challenges of cross-border VC, especially the dependancy on US capital. It kinda reminds me of how many EU tech companies, even from places like Cluj, often end up looking towards the US for growth capital and market access beyond the seed stage.