Geographic Investment Allocation of Canadian Public Pension Funds (2024–2025)

Or: are they investing at home?

Introduction

Canada’s major public pension funds steward more than C$2 trillion in assets on behalf of workers and retirees. Where these funds allocate their capital is strategically important: domestic investment supports national economic growth and infrastructure, while global diversification manages risk and taps broader opportunities.

In an era of sovereignty, self-sufficiency should be at the forefront. This includes our capital markets, as well as their ability to fund important nation-building projects. With that in mind, this report reviews the geographic allocation of some of Canada’s largest public pension funds in 2024 and 2025.

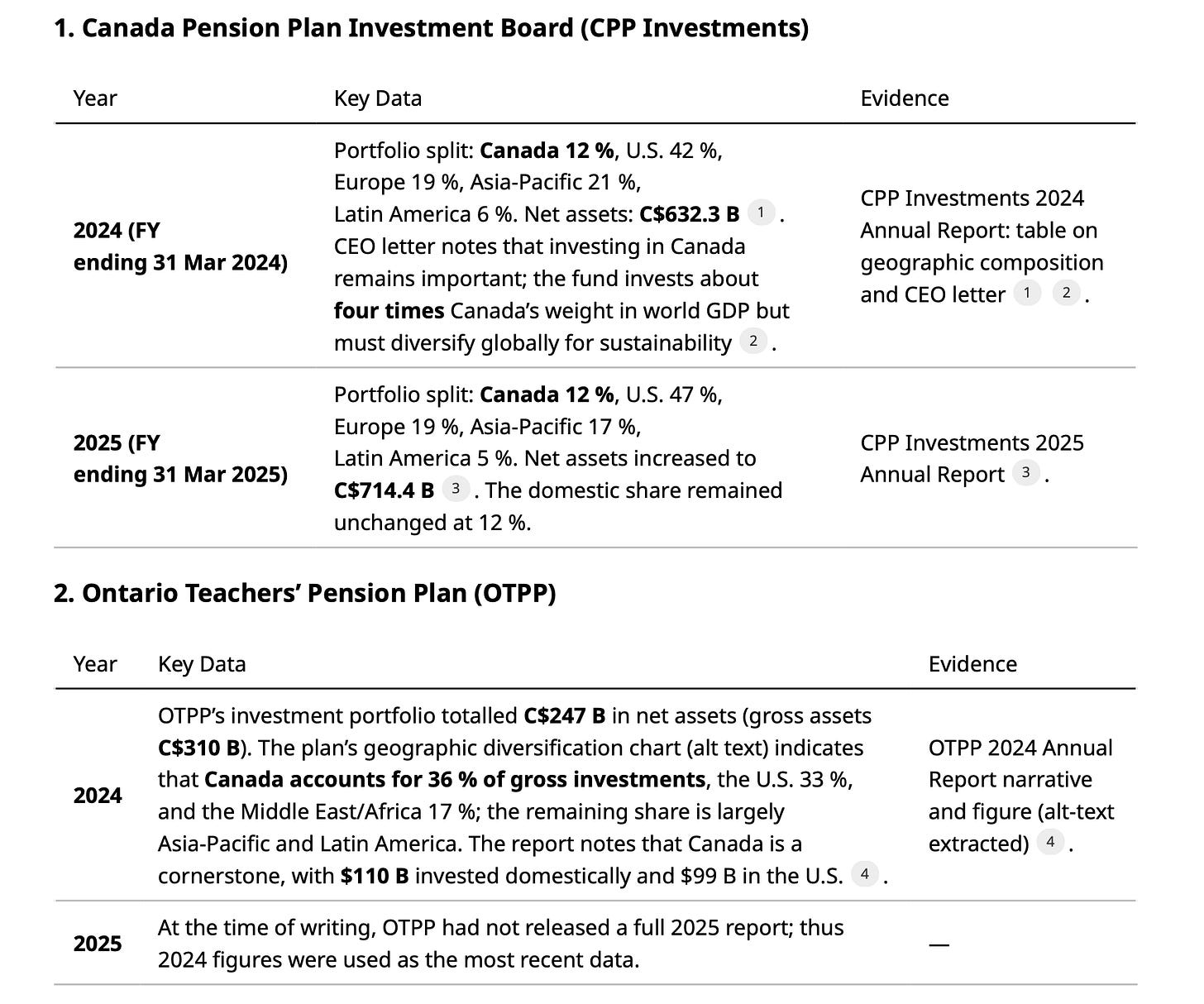

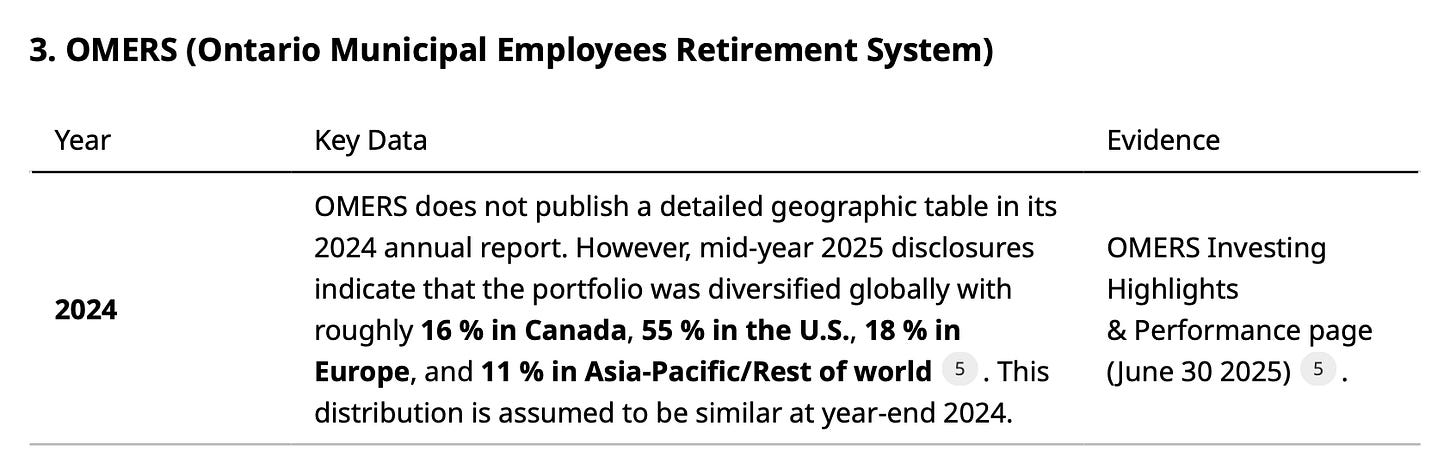

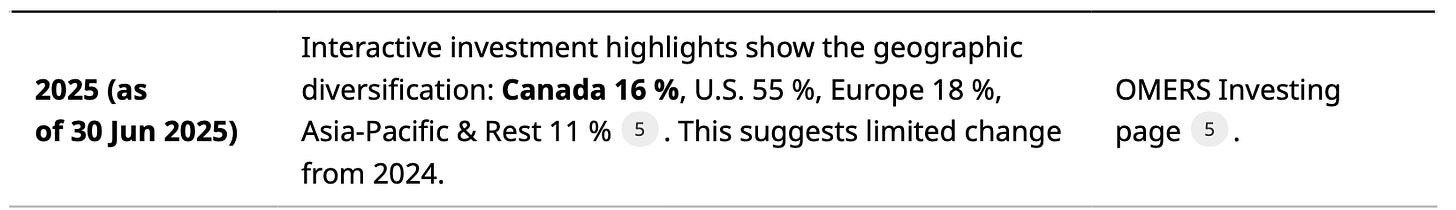

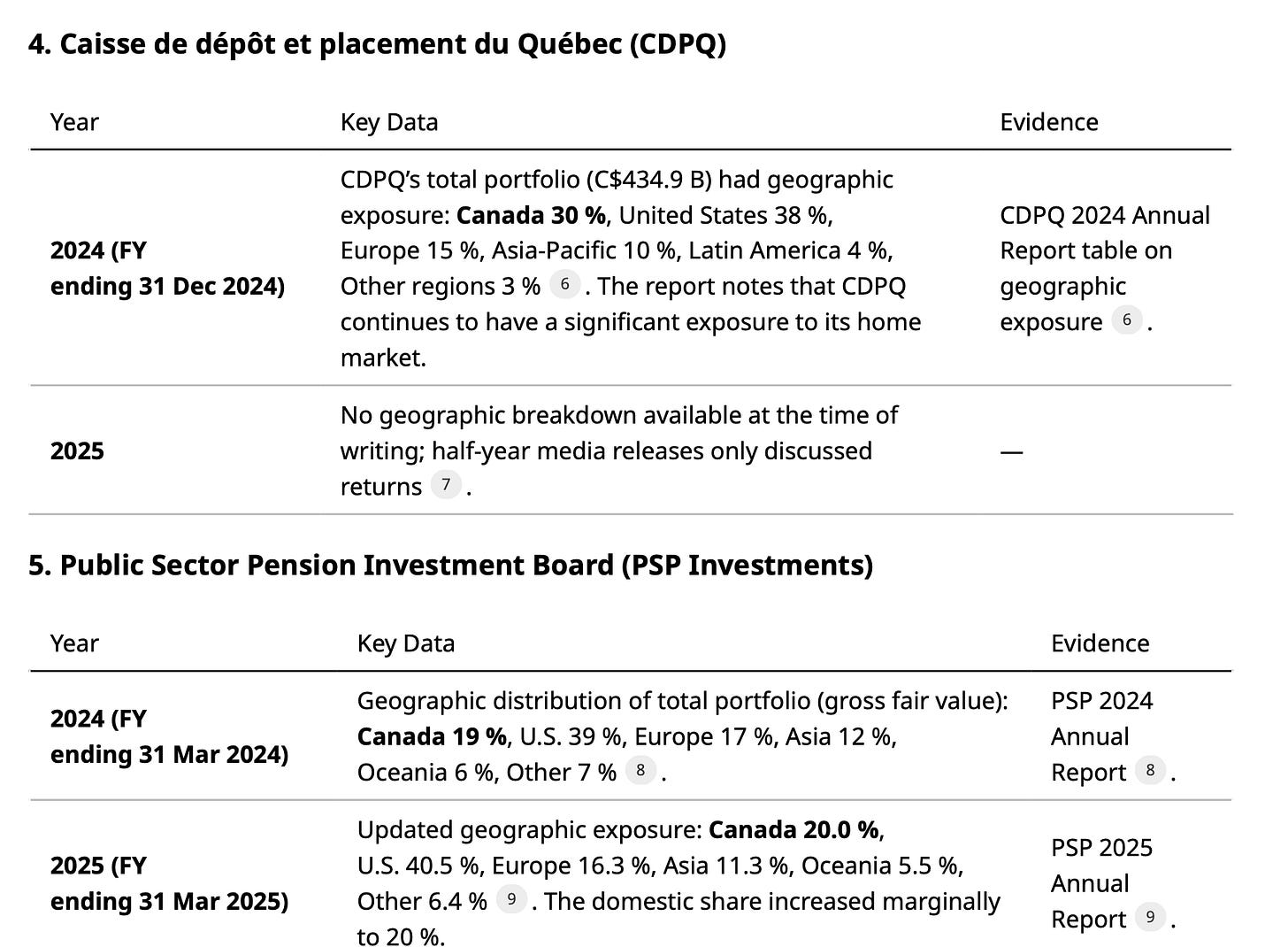

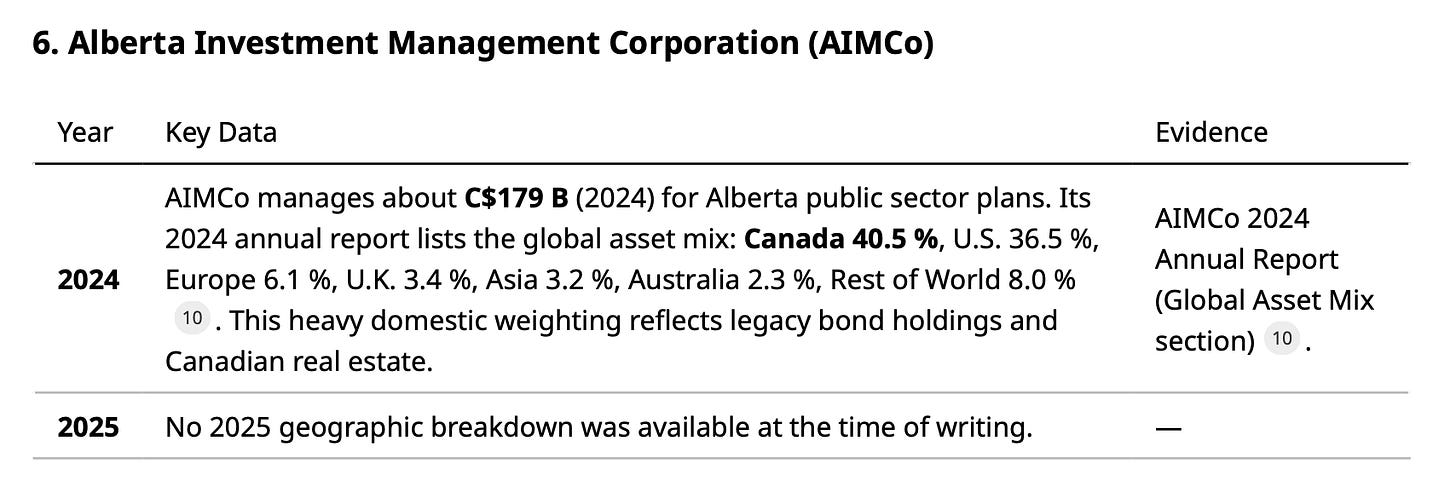

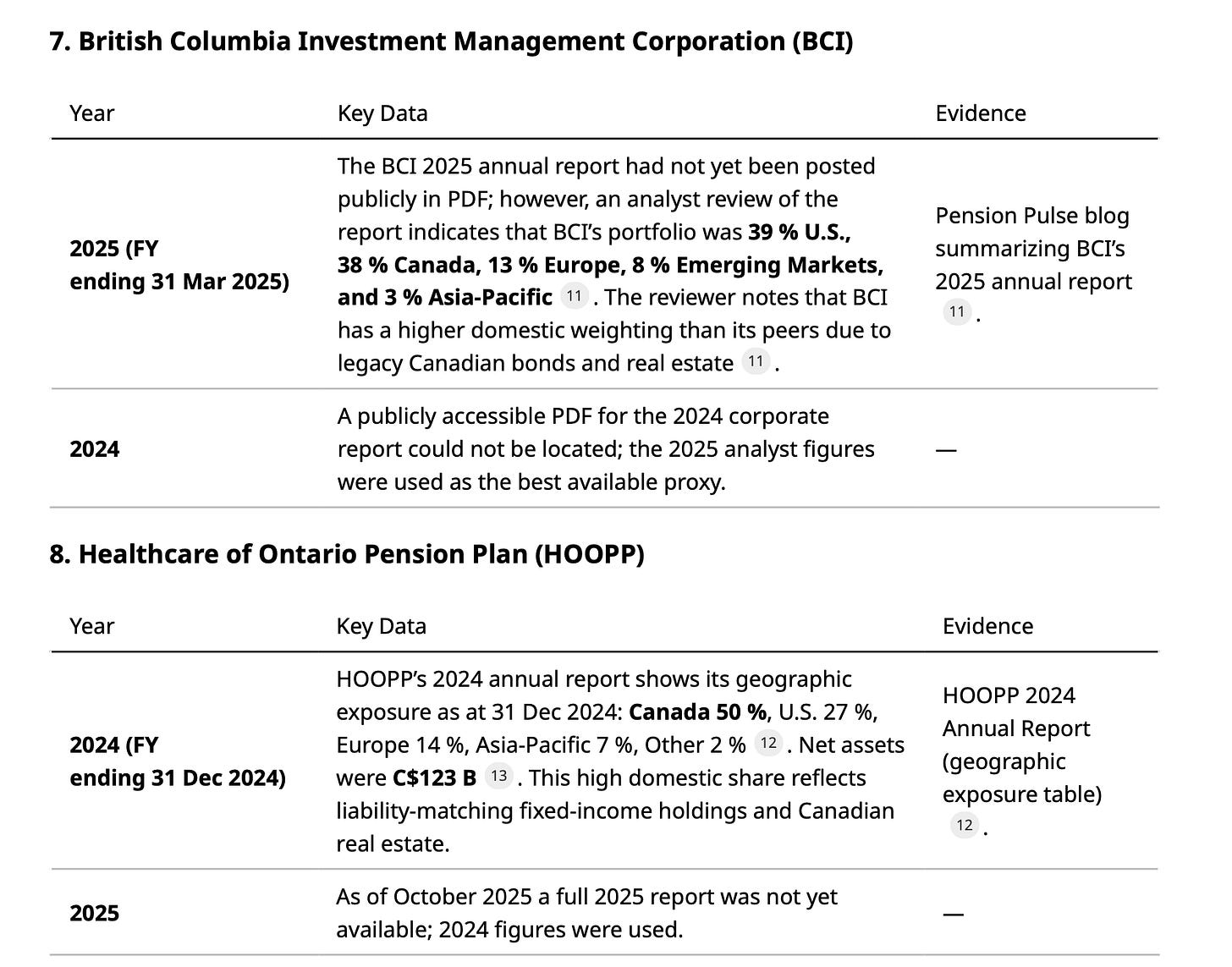

The analysis draws primarily on the most recent annual reports and investment disclosures of each institution. Where 2025 data were not available, the latest available figures were used. Percentages refer to the share of total portfolio value (net assets or gross fair value) invested in each region.

Methodology

Sources – Annual reports for 2024 and 2025 (where available) were parsed using automated tools to locate tables and narrative sections describing geographic diversification.

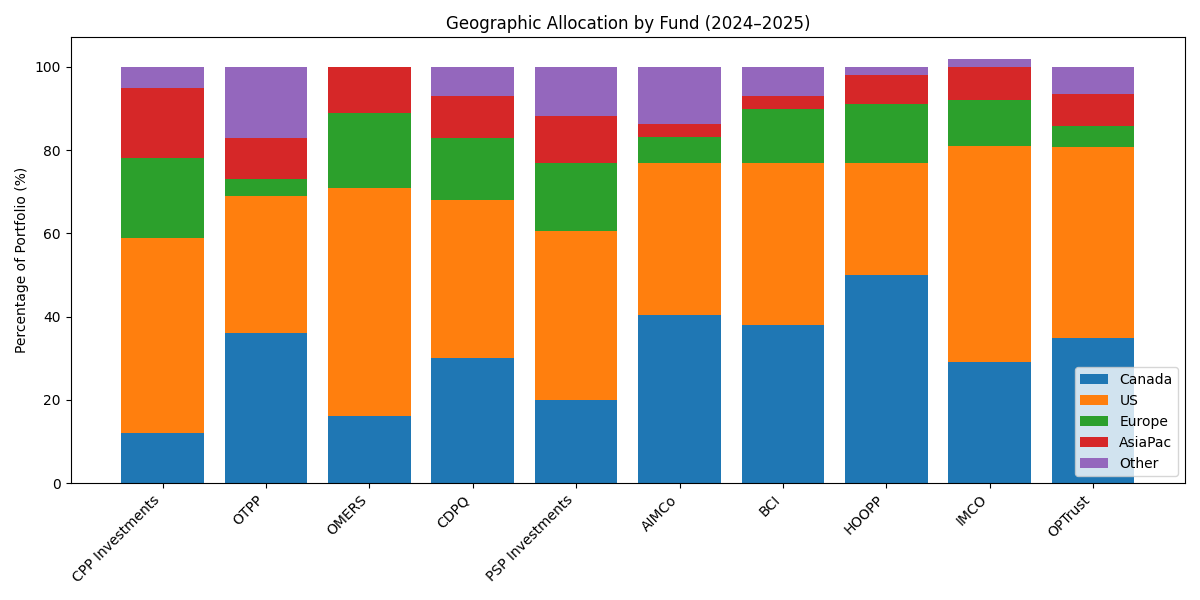

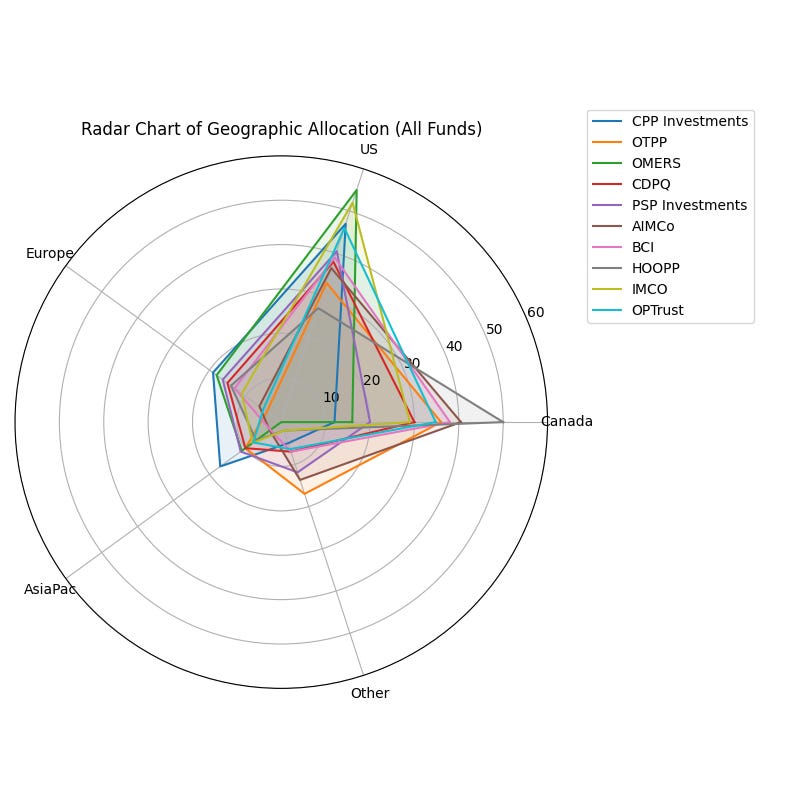

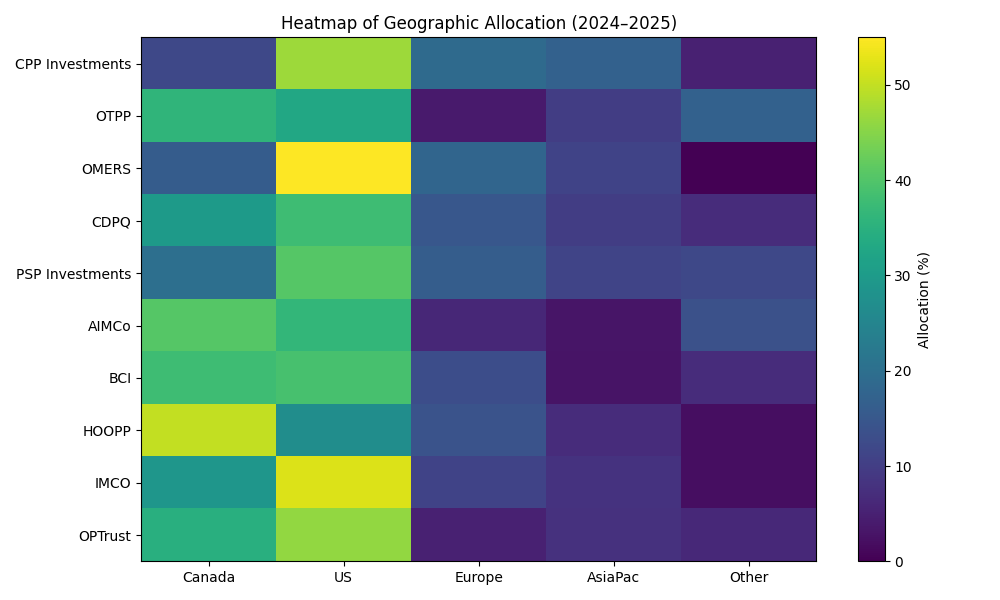

Classification – Investments were categorized into five broad regions: Canada, United States, Europe, Asia‑Pacific, and Other/Latin America/Emerging Markets.

Calculations – For each fund, the reported percentages were normalized to 100 %. Where only regional breakdowns were provided, percentages were aggregated to produce a Canada vs. Rest‑of‑World comparison. All charts were created by us, based on this fact gathering and data processing.

Limitations – Not all funds report a complete geographic breakdown for every asset class. Some figures are rounded. In cases where only partial data were available (e.g., OPTrust and BCI), credible secondary sources (news releases or analyst reports) were used and noted.

Fund‑level Geographic Allocations

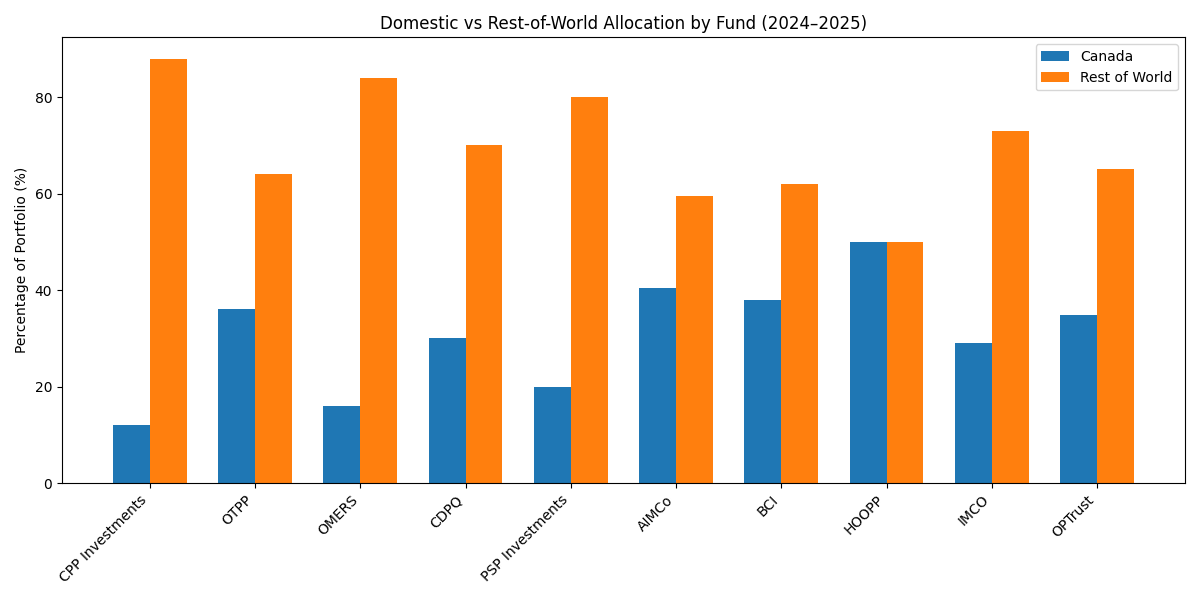

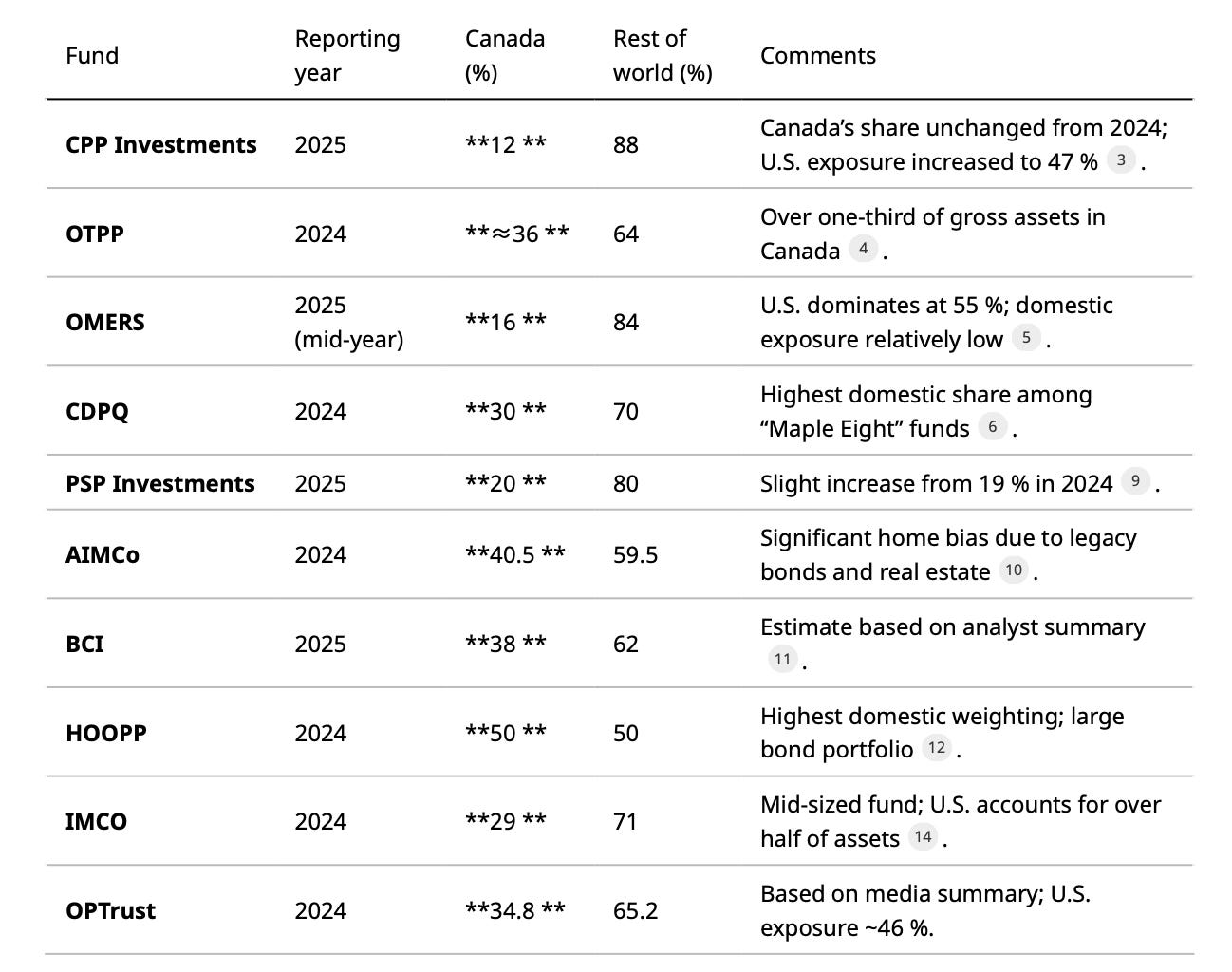

Canada vs. Rest‑of‑World Summary

The table below aggregates the available 2024–2025 data and shows each fund’s domestic share versus its foreign exposure. Funds are grouped by the most recent year available.

Analysis and Discussion

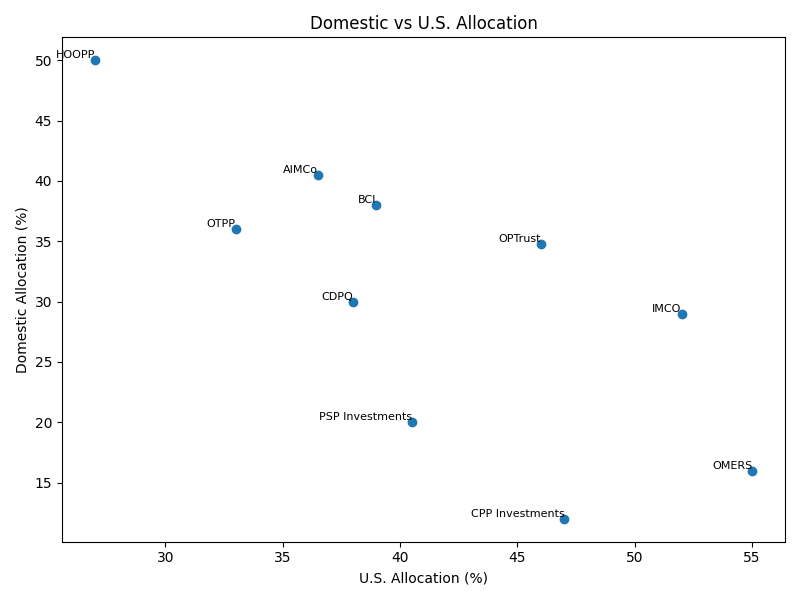

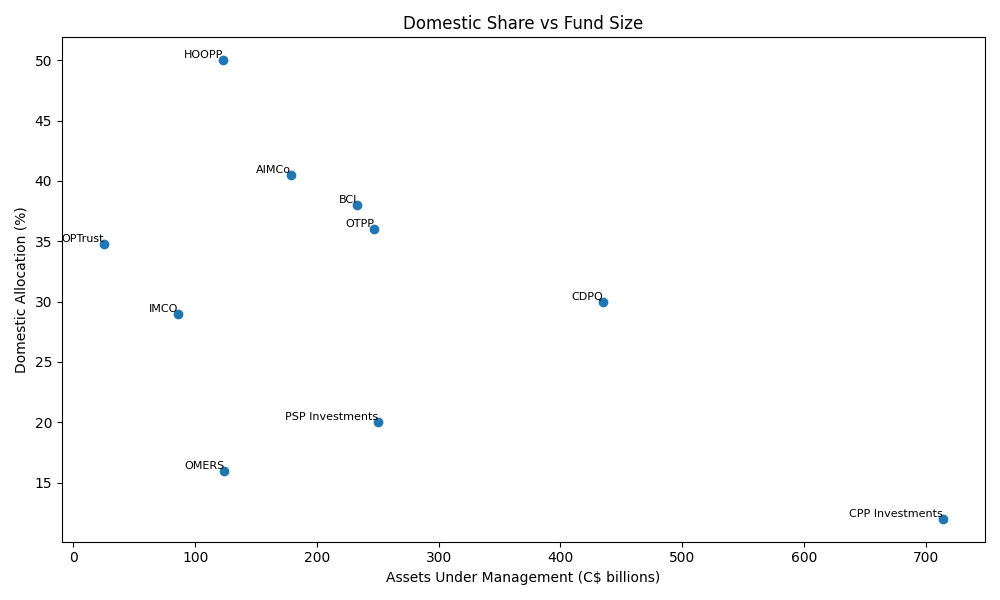

Home Bias vs. Global Diversification

Domestic Allocation:

Across Canada’s major public funds, the share of assets invested in Canada ranges from 12 % to 50 %. CPP Investments and PSP remain the most globally diversified (≈12–20 % domestic), reflecting mandates to maximize risk‑adjusted returns by investing globally. In contrast, HOOPP (50 %) and AIMCo (40 %) retain significant home bias due to liability‑matching fixed‑income portfolios and legacy real estate holdingsdownloads.ctfassets.nethoopp.com.United States Dominance:

For most funds, the U.S. is the largest single foreign market, comprising 33–55 % of assets. IMCO and OMERS each allocate over 50 % of their portfolios to U.S. investmentsomers.comprodhtml.imcoinvest.com. This reflects the depth of U.S. public markets, private equity and infrastructure opportunities relative to Canada.Europe and Asia:

European exposure generally ranges between 11 % and 19 %, while Asia‑Pacific allocations are relatively modest (5–21 %). CDPQ, CPPIB and PSP have larger Asia‑Pacific exposures as part of long‑term diversification strategieslacaisse.comcppinvestments.com.

Emerging Markets and Other Regions:

Latin America, Oceania, and other emerging regions account for 5–10 % of assets in most funds. In the case of BCI, Emerging Markets and Asia‑Pacific exposures total about 11 %pensionpulse.blogspot.com.

Trends between 2024 and 2025

Stability in Domestic Share: CPPIB and PSP maintained similar domestic allocations from 2024 to 2025 (12 % and 20 % respectively), suggesting a stable home‑bias policy despite growth in total assetscppinvestments.cominvestpsp.com.

Marginal Increase in U.S. Exposure: CPPIB and PSP increased U.S. exposure by several percentage points (e.g., CPPIB from 42 % to 47 %), reflecting strong performance of U.S. equities and private assetscppinvestments.com.

Focus on Global Diversification: Smaller funds like IMCO and OMERS report that roughly two‑thirds to four‑fifths of their portfolios are invested outside Canadaomers.comprodhtml.imcoinvest.com. The trend suggests rising emphasis on global assets to enhance returns and manage risk.

Policy Implications

Domestic Capital Formation – Funds with low domestic allocations (e.g., CPP Investments, PSP) may be perceived as exporting Canadian savings abroad. However, these funds argue that global diversification is essential to meet long‑term return obligations and that they still invest in Canadian infrastructure and innovation at levels well above Canada’s share of global GDPcppinvestments.com.

Infrastructure and Housing – Provincial funds like AIMCo, BCI and HOOPP with higher domestic weights could be key partners for nation‑building projects (housing, clean energy, transit). Their large fixed‑income and real‑asset portfolios provide steady capital for long‑duration domestic projects.

Regional Balance – The variability of domestic exposure (12–50 %) raises questions about consistency in national investment policy. Policymakers may consider incentives or frameworks that encourage funds to deploy more capital in Canada without compromising fiduciary duties—e.g., through co‑investment platforms with government or risk‑sharing mechanisms.

Transparency – Some funds (BCI, OPTrust) provide limited or no public geographic breakdowns. Improved transparency would allow stakeholders to better assess the economic impact of public savings.

Comparisons with International Peers – Canadian funds are lauded for their global diversification and high governance standards. Norway’s sovereign wealth fund, for instance, invests only about 3 % domestically, reflecting a model that maximizes global exposure. Canada’s funds, with domestic shares averaging 30 %, occupy a middle ground between global diversification and home investment.

Conclusion

Canadian public pension funds collectively manage enormous pools of capital and have a material impact on the national economy.

Diversification dominates: Most funds allocate 70–80 % of assets outside Canada.

Domestic investment remains significant: Even with global diversification, tens of billions of dollars are invested domestically across fixed‑income, real estate, infrastructure and private equity.

Variation among funds: HOOPP and AIMCo have large home allocations, whereas CPP Investments and PSP have the lowest.

For policymakers, the key challenge is to balance the benefits of global diversification—which supports pension sustainability—with domestic economic development objectives.

Enhancing co‑investment platforms, improving transparency and encouraging targeted domestic investments in strategic sectors could help align these goals without compromising fiduciary duties.

Sources

1, 2 Annual Report 2024 - CPP Investments https://www.cppinvestments.com/wp-content/uploads/2024/07/CPP-Investments-F2024-Annual-Report.pdf

3 CPP-Investments F2025-Annual-Report-English https://www.cppinvestments.com/wp-content/uploads/attachments/CPP-Investments-F2025-Annual-Report-English.pdf

4 OTPP 2024 Annual Report – Investing to make a mark https://www.otpp.com/content/dam/otpp/documents/reports/2024-ar/otpp-2024-annual-report-eng.pdf

5 OMERS Investing https://www.omers.com/investing

6 2024 Annual Report – CDPQ https://www.lacaisse.com/sites/default/files/medias/pdf/en/ra/2024_cdpq_annual_report.pdf

7 La Caisse posted a mid-year 2025 return of 4.6% over six months and 7.7% over five years | La Caisse https://www.lacaisse.com/en/news/pressreleases/caisse-posted-mid-year-2025-return-46-over-six-months-77-over-five-years

8 Public Sector Pension Investment Board 2024 Annual Report https://www.investpsp.com/media/filer_public/03-our-performance/annual-report-2024/pdf/PSP-2024-annual-report-en.pdf

9 Public Sector Pension Investment Board – 2025 Annual Report https://www.investpsp.com/media/filer_public/03-our-performance/annual-report-2025/pdf/PSP-2025-annual-report-en.pdf

10 AIMCo Annual Report, 2025 https://downloads.ctfassets.net/lyt4cjmefjno/2CNRCPFCvWXILDTyWFS0Tu/8ce552786d7bbba0857f035a48169d6c/AIMCo-2024-

11 BCI Gains 10% in Fiscal 2025

https://pensionpulse.blogspot.com/2025/06/bci-gains-10-in-fiscal-2025.html

12, 13 Hoop Annual Report, 2024

14, 15 IMCO 2024 Annual Report, Investing with discipline https://prodhtml.imcoinvest.com/static-assets/pdf/2024/imco-annual-report-2024.pdf