Canadian Business Owner’s Guide to Recapitalizations and Partial Exits

Learn how Canadian founders can extract cash without giving up control through minority recapitalizations. Data, trends, case studies and strategy playbook.

This guide is written for founders and investors exploring recapitalizations and partial exits in Canada. It combines recent data (as of 2025) with best‑practice insights drawn from legal practitioners, private equity sources and government programs.

🔍 Executive Summary

Recapitalization lets a business owner secure liquidity without selling

everything. In a minority recapitalization, the founder partners with a

financial sponsor who provides a blend of debt and minority equity.

This structure allows owners to extract cash, refinance obligations or buy out

passive shareholders while still retaining control.

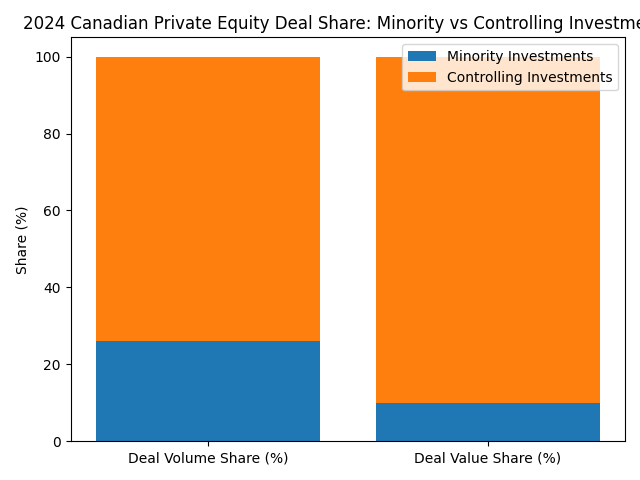

Canadian deal activity in 2024 and early 2025 remained healthy yet subdued

relative to pre‑pandemic highs; minority investments accounted for only about

26 % of deal volume and 10 % of deal value in 2024 (practiceguides.chambers.com),

suggesting a shift toward majority buyouts.

Nevertheless, the demand for founder liquidity persists. This guide explains why recapitalizations matter, how they work, current market statistics and how Canadian founders can use them to unlock wealth while continuing to build their companies.

🧩 Context & Why Recapitalization Matters

Fewer exits and tougher IPO markets.

Private‑equity exits in Canada rebounded to CAD 6.7 billion across 86 exits in 2024, but there were no IPOs (practiceguides.chambers.com).

Dealmakers expect exit markets in 2025 to remain muted due to macro‑economic uncertainty and the lack of an active public market (practiceguides.chambers.com). Founders therefore need

alternative ways to realise value.

Liquidity demands and investor appetite.

High interest rates and geopolitical shocks have compressed valuations and slowed growth capital rounds.

Private equity firms are still sitting on record dry powder and

looking for creative deployment—minority recapitalizations allow them to

put capital to work while partnering with management (cyprium.com).

Policy shifts favour investment.

Canada’s new federal government elected in May 2025 has signalled a more pro‑business agenda and introduced infrastructure and free‑trade initiatives that could stimulate investment activity (practiceguides.chambers.com).

This macro backdrop, combined with the slowing IPO pipeline, makes recapitalizations an attractive tool for founders seeking liquidity.

💡 Key Insights About Recapitalizing Your Business

Minority recapitalization defined. A minority recapitalization is a

transaction where the company reorganises its capital structure by adding a

mix of debt and minority equity from an investor. The founder receives

cash while retaining majority control and flexibility to run the business. Junior capital or preferred stock sits between debt and common equity, providing higher yield and no principal amortization (cyprium.com).Market share of minority investments is small but persistent. CVCA data

show that minority investments represented 26 % of Canadian private‑equity

deal volume and 10 % of deal value in 2024 (practiceguides.chambers.com).

Controlling stakes dominated, reflecting investor preference for buyouts;

however, the availability of minority capital offers founders another

liquidity path.2025 trends: healthy investment, cautious exits. In Q1 2025, private‑equity

investment levels mirrored Q1 2024, with Québec and Ontario leading deal

value and volume. Exit activity was more muted

with few disclosed M&A exits and no IPOs, due partly to macro

uncertainty (practiceguides.chambers.com).Dual‑track processes improve price discovery. Running an M&A sale and

IPO process concurrently—the “dual track”—can create price tension,

encourage multiple bids and provide transaction certainty. Legal advisors

note that this strategy gives companies flexibility to pivot between

alternatives and improves valuations (blakes.com).Government‑backed growth equity. BDC’s Growth Equity Partners fund

invests $3–45 M in mid‑market companies as a minority investor

(stakes up to 49 %), providing growth capital and liquidity while

partnering with management (bdc.ca). Fund III launched

in 2024 and manages about CAD 900 million.Case studies illustrate flexibility.

Dejero, a Waterloo‑based communications company, executed a CAD 60 M minority recapitalization in April 2021, partnering with Vertu Capital and Ubicom Ventures to accelerate growth without ceding control (prnewswire.com, gowlingwlg.com).

Another example is Connect Telecommunications Solutions in Kitchener, which received a US$ 41.4 M minority recapitalization from Main Street Capital in October 2024 (mainstcapital.com).

Investors’ interest in minority recaps is growing. RBC Capital Markets

reports that sponsors and private‑equity funds are exploring minority recaps

as an alternative liquidity path, allowing founders to “take some chips off

the table” while maintaining upside (rbccm.com).

🛠 How It Works: Anatomy of a Minority Recapitalization

Initial assessment & goals.

The founder evaluates why liquidity is needed—retirement planning, partial de‑risking, buying out passive shareholders or raising growth capital.

A trusted advisor or investment bank helps articulate these objectives and determines whether a minority recap is appropriate versus alternatives (outright sale, dividend recap or IPO).

Valuation and investor selection.

Potential investors (private‑equity funds, growth equity firms, family offices or pension funds) are solicited.

The company’s value is determined based on earnings (EBITDA), growth prospects and comparable transactions.

Bids can include preferred equity, subordinated debt or convertible instruments (cyprium.com).

Structuring the deal.

The recap capital stack usually combines senior debt (from banks), junior capital (subordinated debt or preferred shares) and minority common equity.

Junior capital carries higher yields and no amortization (cyprium.com).

A shareholder agreement sets governance, board rights, veto matters and exit provisions.

Due diligence & documentation.

Investors conduct commercial, legal and financial due diligence.

Key issues include forecasting growth, assessing management continuity, and evaluating potential regulatory or foreign investment approval—particularly important in Canada with stricter competition and national security reviews (practiceguides.chambers.com).

Closing & capital deployment.

The founder receives a partial cash

payout; the company refinances existing loans and retains cash for growth.Proceeds may also be used to repurchase shares from existing shareholders.

Post‑transaction governance.

The investor often receives board seats

and veto rights on major decisions, but the founder retains operational

control.The parties plan an eventual exit—via strategic sale, secondary

buyout or IPO—usually within a 3–7‑year horizon.

🧠 Minority vs Majority Recapitalizations

A minority recapitalization allows a founder to retain more than 50 percent ownership and operational control while gaining access to liquidity. It typically blends senior debt, subordinated or preferred debt, and minority equity.

This structure enables founders to unlock part of their company’s value without ceding majority control, and investors usually obtain a single board seat and certain veto rights.

Because the capital stack relies more on junior or mezzanine instruments than on pure equity, it is generally less dilutive than a buyout. These structures are common when founders seek partial liquidity, wish to buy out passive shareholders, or need growth capital for expansion.

According to Cyprium Partners’ white paper on minority recapitalizations (cyprium.com), this approach provides liquidity to owners while preserving long-term control and continuity of leadership.

In contrast, a majority recapitalization occurs when the founder sells more than 50 percent of equity, transferring control to the new investor. The incoming capital is mainly majority equity, sometimes supported by leveraged financing.

These transactions tend to be more dilutive to the founder, who might retain only a small “rolled-over” minority stake. Investors often appoint new executives or expand board representation.

Majority recaps are common in succession planning, full exits, or platform-building strategies where outside investors take over operations.

📊 Data, Trends & Recapitalization Case Studies

Canadian market statistics

2024 minority investment share. The CVCA reports that Canadian private‑equity

firms invested CAD 2.8 billion across 164 minority deals in 2024,

representing 26 % of deal volume and 10 % of deal value

By contrast, controlling transactions accounted for the remaining 74 % of

volume and 90 % of value. The dominance of buyouts reflects investors’ desire

for control and synergy opportunities. (practiceguides.chambers.com).

Q1 2025 snapshot. Investment in the first quarter of 2025 mirrored Q1 2024

levels, with Québec leading deal value and volume and Ontario following closely.

The most active sectors were industrial and manufacturing, information/communication technology and financial services. Exit activity was subdued; only a handful of M&A exits were disclosed and there were no IPOs (practiceguides.chambers.com).

💼 Case Studies

Dejero (2021 – Minority Recap):

In 2021, Vertu Capital and Ubicom Ventures invested approximately CAD 60 million in Dejero, a Kitchener-based provider of connectivity and cloud solutions. The transaction was structured as a minority recapitalization, enabling management to retain control while securing growth capital. The investment accelerated international expansion and preserved founder leadership (PR Newswire; Gowling WLG).

Connect Telecommunications Solutions (2024 – Minority Recap):

In 2024, Main Street Capital provided US $41.4 million in first-lien senior debt and minority equity to recapitalize Connect, a Kitchener-based fibre-management software company. The investment combined credit and equity to deliver liquidity while allowing the founders to continue leading the business with institutional backing (Main Street Capital).

Canadian Market Data (2024):

Minority private-equity investments represented roughly 26 percent of all deals by count and 10 percent of total deal value in 2024, according to Chambers & Partners – Private Equity 2025 Canada (practiceguides.chambers.com). This shows that while minority transactions remain a smaller slice of the market compared to buyouts, they are gaining relevance as founders seek flexible liquidity solutions.

Figure: Minority vs Controlling Investment Share in 2024. Data from CVCA.

Minority deals comprise just over a quarter of transactions by count and only

one‑tenth by value, illustrating the dominance of buyouts.

Additional trends

Investors exploring recaps. RBC Capital Markets notes that private‑equity

sponsors are considering minority recaps to allow founders to monetise

portions of their equity while positioning companies for eventual IPOs or

sales (rbccm.com).Secondary buyouts dominate exits. Secondary buyouts accounted for 70.6 %

of Canadian private‑equity exit value in 2024 (practiceguides.chambers.com),

highlighting investors’ preference for staying private and trading assets

among sponsors. This dynamic can facilitate later exits for minority

recapitalisations.Legal scrutiny of minority holdings. Canada’s Competition Bureau now

routinely requests information on private‑equity investors’ minority

shareholdings during merger reviews and has unwound transactions where

investors held competing businesses (practiceguides.chambers.com). Founders

considering minority recapitalisations should anticipate extended regulatory

review.

🧭 Minority RecapStrategy Playbook

For Founders

Clarify objectives. Decide whether you need capital for expansion,

personal liquidity or to buy out partners. Minority recaps work best when

owners want to de‑risk but continue leading the company.Assemble your team. Hire experienced advisors—corporate finance

advisors, lawyers and tax professionals—to run a structured process and

negotiate investor terms. A dual‑track strategy (parallel IPO and M&A) can

strengthen bargaining power (blakes.com).Prepare the company. Ensure financial statements are audit‑ready, update

business plans and address any operational or legal risks. This preparation

speeds due diligence and signals professionalism.Choose the right partner. Evaluate investors’ track records, sector

expertise and alignment with your vision. Seek those willing to invest in

growth and accept a minority stake without dictating day‑to‑day decisions.Negotiate governance. Retain control by agreeing on reserved matters

where investor consent is needed (e.g., major acquisitions, new debt). Ensure

that any exit rights (drag‑along, tag‑along) are reasonable and balanced.Plan your future exit. Discuss the anticipated exit horizon and

potential buyers. Secondary buyouts, strategic sales or IPOs may be options.

Align incentives so that the investor supports the ultimate exit strategy.

For Investors

Target sectors with steady cash flows. Minority recaps work well in

industries with predictable earnings where leverage can be comfortably

serviced (e.g., industrials, technology and services). CVCA data show these

sectors were the most active in Q1 2025 (practiceguides.chambers.com).Use creative capital structures. Combine senior debt, mezzanine debt and

preferred equity to meet founders’ liquidity needs while protecting the

downside (cyprium.com).Align incentives. Offer performance‑based earn‑outs or option pools to

keep founders motivated. Avoid overly restrictive covenants that could

impede growth.Manage regulatory risk. Assess competition and foreign‑investment

considerations early; minority shareholdings across competing businesses may

attract scrutiny (practiceguides.chambers.com).

For Policymakers

Facilitate minority investment vehicles. Support programs like BDC’s

Growth Equity Partners that provide non‑dilutive capital to founders and

encourage more Canadian investors to pursue minority positions.Streamline regulatory approvals. Continued coordination among federal

and provincial regulators can reduce delays in merger reviews. The new

government’s Bill C‑5 seeks to remove internal trade barriers and improve

infrastructure permitting (practiceguides.chambers.com); similar efforts could

bolster M&A activity.Promote financial literacy. Equip founders with education on recapital

options, tax consequences and succession planning so they can make informed

decisions and avoid distress sales.

🇨🇦 Canadian Angle

Canada’s private‑equity market is dominated by mid‑market transactions.

Government‑backed programs and home‑grown investors play a unique role.

Several domestic programs and institutions support this minority-friendly approach.

Leading Canadian growth equity programs

BDC Growth Equity Partners—a division of the Business Development Bank of Canada—acts as a minority investor in mid-market companies, typically taking stakes of up to 49 percent. It invests between CAD 3 million and CAD 45 million per transaction, and its third fund launched in 2024 with approximately CAD 900 million under management (bdc.ca).

Export Development Canada (EDC) provides structured financing and sometimes minority equity to exporting firms, especially those in technology or clean-tech scale-ups. Typical transaction sizes range from CAD 5 million to 25 million.

Canada’s largest pension funds—including CPPIB, OMERS, and Ontario Teachers’—also engage in minority growth investments either directly or through private-equity partners, often with ticket sizes exceeding CAD 50 million.

Finally, regional private-equity firms such as Vertu Capital, Georgian Partners, and Vertix Investments specialize in minority growth capital for technology-driven companies, typically investing between CAD 20 million and 100 million.

Together, these players form a uniquely Canadian landscape in which founders can access liquidity and institutional support without surrendering control—an increasingly attractive middle ground between growth financing and a full sale.

Canadian considerations

Tax & succession planning: Capital gains exemption rules, estate freezes and

family‑trust structures can significantly influence how recapitalisation

proceeds are taxed. Founders should consult tax advisors.Corporate statutes: Canadian corporations legislation requires special

shareholder approvals for significant transactions and “majority of minority”

approval for related‑party deals (practiceguides.chambers.com).Regional economic differences: Quebec and Ontario lead in private‑equity

deal volume (practiceguides.chambers.com); western provinces often see more

energy and resources deals. Knowing local tax credits (e.g., Quebec’s C3i

incentive) can enhance returns.

🏁 Bottom Line

Minority recapitalization provides liquidity and growth capital without

surrendering control. It mixes debt and minority equity so founders can

de‑risk and continue leading their businesses (cyprium.com).The market for minority deals is small but material. In 2024, such deals

represented 26 % of Canadian PE transactions by count and 10 % by value

(practiceguides.chambers.com). While controlling buyouts dominate, minority

recaps remain a viable option.Macro uncertainty favours flexible liquidity solutions. With muted

IPO markets and caution among buyers in 2025 (practiceguides.chambers.com),

recapitalizations help founders realise value without timing the market.Partner selection and structure are critical. Align investor goals,

preserve governance rights and negotiate clear exit pathways. Government

programs like BDC Growth Equity Partners provide founder‑friendly minority

capital (bdc.ca).

In summary, recapitalizations—especially minority structures—have become a powerful alternative for Canadian founders seeking liquidity without giving up control. They allow entrepreneurs to extract value, reward early investors, and fund expansion while keeping leadership continuity intact.

With a growing ecosystem of domestic partners such as BDC, EDC, and mid-market private-equity firms like Vertu and Georgian, Canada is well positioned to foster more of these balanced transactions.

As private capital markets mature, minority recaps are emerging as a pragmatic bridge between independence and institutional growth—helping founders stay at the helm while accelerating their company’s next chapter.

Risk Disclaimer and Intended Use: This guide is intended to act as an educational resource, - not a definitive recommendation. Please reference underlying sources directly for further details. This guide is not a recommendation to raise capital from investors, US-based or otherwise. If you need advice for your business, you are welcome to contact us for a referral.